Lyn Alden is the founder of Lyn Alden Investment Strategy, where she provides market research to tens of thousands of individual investors and financial professionals. With a focus on income-generating investments, she provides the overall macro picture of the industry. Lyn reminds us why it is important to look at the bigger picture, especially in crypto. With her weekly newsletters and informative research, she has become a known name in the Industry. Please take a look.

Lyn Alden

Interview Date : 13th October 2020

My name is Lyn Alden. I run the Lyn Alden Investment Strategy site. My background is not specifically for Bitcoin, but I specialize in a broad spectrum of different asset classes including equities, bonds, precious metals, and other alternatives as it in this case includes Bitcoin. My approach to these different asset classes is to research and find out where value and growth potential lies. That is how I started delivering a lot of Bitcoin writing to my audience. I started being active in the crypto space a little bit in 2017, but I became quite bullish on it in April 2020. Since I have been a little bit more forthright about how bullish I am about Bitcoin.

I provide research for both retail investors and institutional investors. I provide my audience with articles and a free newsletter. I also have a low-cost premium usually coming out every 2 weeks. I combine macro analysis with a Company’s specific analysis and look at different factors. For example, what is going on with unemployment, liquidity, fiscal stimulus, etc., are some of the major drivers for different asset classes. I dive into individual companies, taking that macro background and combining it with individual investments.

When Did You Discover Cryptocurrencies For The First Time?

I became aware of Bitcoin back in 2011. I had a friend that mined on her computer. I thought it was a much-needed technology and a great idea at that time, but I never got fully knowledgeable about it. It was kind of viewed as a novelty, and I just thought it was a neat technology. I buy any at the time, unfortunately, but every year thereafter, I would check on the space a couple of times. It was not until 2017 when the big bull market was rising exponentially, and when it got a lot of media attention, that I started to cover it. I received a lot of emails from my audience asking me to cover it, and then at the time when I was writing my first article about it, the price of bitcoin went from 6000 dollars to 8000 dollars. I analyze it in a couple different ways; one way was to look at it as a medium of exchange, and the other way was to research it as a medium for store of value. I determined that it was probably overvalued as a medium of exchange, but pretty interesting as a store of value.

When Did you Enter The Rally?

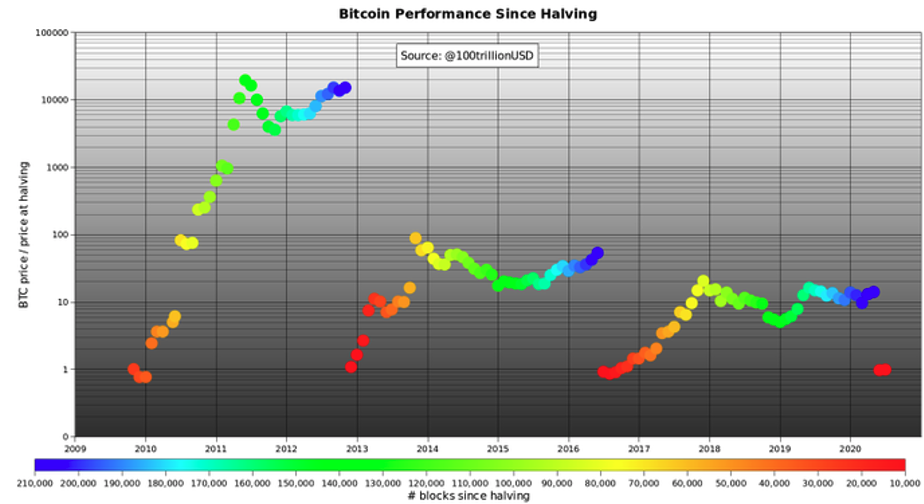

Due to how overbought it was at the time, and how much enthusiasm there was, I took no position and I leaned bearish on it in the near term in 2017. Then, it went all up to 20 000 dollars and crashed down to under 4000 dollars. Moreover, when it had the drawdown with most other asset classes in March of 2020, it round-tripped all the way down to under 5000 dollars again. However, it was back to the 6-7000 dollars range roughly one month later, and that’s when I started to analyze it. Things changed after that; the macro factor was much better, we have low-interest rates, big fiat money creation, etc. Bitcoin was coming up to a halving event in May 2020, and I did a bit more research on Bitcoin halving cycles to see what the price schemes of Bitcoin looked like. Now we know that there is a bullish trend 2 years after the launch of halving cycles, whereas 2 years before halving cycles, Bitcoin tends to be consolidation periods.

So, there is a period where Bitcoin is going to do well and a period it is not. I became more bullish this time than ever, and that is why I recommended it and I went along myself.

What To Know Before Joining

I have a degree in engineering, so I generally come at things from a technical perspective. I have done some coding, but I am not really much of a coder, so I have never really looked at Bitcoins software, for example. For me, the technical part, such as the key things that the non-technical people have to understand, is the core ideas of how it works; how the encryption works, how blockchain works, how the peer-to-peer system works, why it is limited to 21 million coins, what would be required to change any of its major features like the consensus mechanism which it uses, etc. Non-technical people still need to understand enough of the technical aspect to understand the asset class.

Taking A Third Person Standpoint

Part of my work in 2017 was trying to figure out more about those hard forks. We experienced a couple of hard times in the industry, and I was concerned that Bitcoin was losing market share among other cryptocurrencies due to that. Multiple other cryptocurrencies were outpacing it, so the Bitcoin market share fell into the 40% range of market share. Even though any cryptocurrency coin is scarce and there can only exist a certain number of units based on the way their consensus protocol, anyone can create a new cryptocurrency. I was worried thinking “what if they all dilute each other?” or “What if there are no 1 or 2 coins that gain most market share, network effects or do not have their individual coins growing in value?” Especially during hard forks, there were debates about which direction it would go in terms of block size, and all the pros and cons. I just watched the space, and eventually saw the settlement established. Up to that time, I kept researching technically why a certain block size is better than another from an outside perspective. I was convinced that Bitcoin had enough of a network effect to hold value even if thousands of cryptocurrencies would be created. Bitcoin survived the hard forks and thousands of new challenges. It has security, the hash rate, simplicity, and decentralization which are all major aspects we want. Therefore, learning enough about the technical aspects to make sure I know what I am getting myself into is how non-technical people have to approach it.

Bitcoin Is Viewed As Digital Gold

As the saying goes software is eating the world, software comes from one industry and it goes to another industry, and it keeps attacking whatever the status quo is. Similarly, Bitcoin is a software attacking money that digitizes gold in a way. We can say it is a scarce digital store of value that has some advantages over gold, including being more portable, harder to confiscate, easier to verify, and has lower transaction costs. I think the way to understand some of the main macro factors about Bitcoin, is to compare it to the alternative which is fiat currency. If someone can hold money in the bank keeping all their value in it, and even grow their value from positive interest rates, it would make a low incentive to take that money and instead put it in gold or Bitcoin.

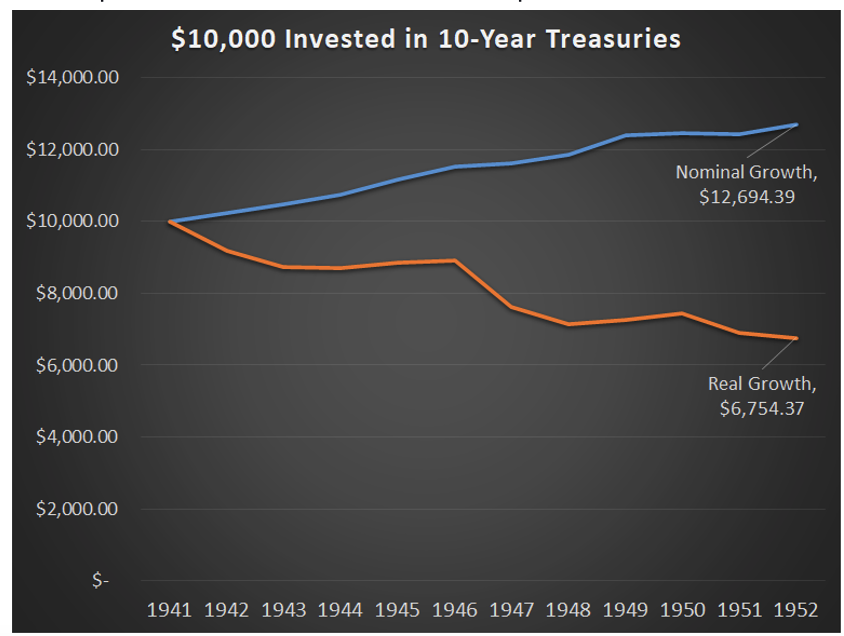

What Is Happening To My Money in The Banks

Historically, there has been currency devaluation where governments have printed a massive amount of money, or they have a prolonged period of interest rates being below the inflation rate. So, they slowly chip away your wealth over time. In those periods, those scarcer assets tend to do very well. Thus, whether it is gold, silver, equities. real estate or in this case Bitcoin, I think going back to the history of fiat devaluation and why they tend to happen, why they don’t happen in some periods but do in other time frames is important.

It is insightful to know why we have had big devaluation all in one decade alone, for example. Understanding the difference between real interest rates and nominal interest rates; not just looking at interest rates, but also at “interest rate” – “inflation rate” to see what is truly happening to my money in the bank. Knowing what is happening to my sovereign bonds, and looking at those alternatives to understand why the case for gold and Bitcoin makes sense in this environment.

Interviewer , Editor : Lina Kamada

【Disclaimer】

The Article published on this our Homepage are only for the purpose of providing information. This is not intended as a solicitation for cryptocurrency trading. Also, this article is the author’s personal opinions, and this does not represent opinion for the Company BTCBOX co.,Ltd.