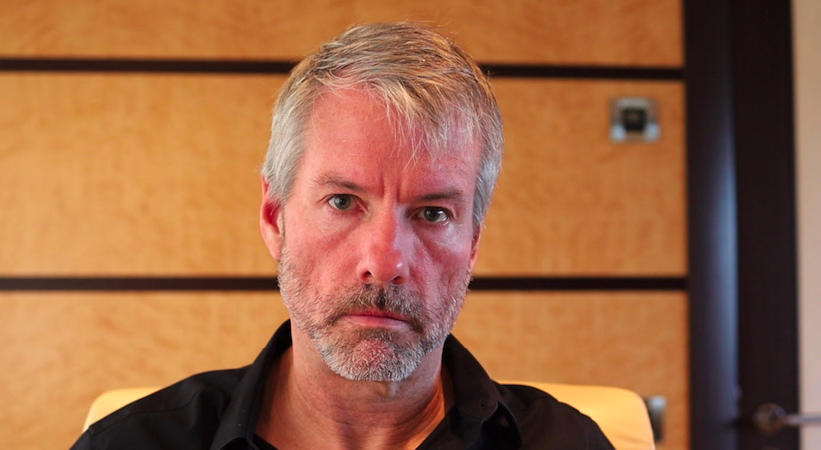

Michael Saylor is an American entrepreneur, inventor, author and the CEO of MicroStrategy. He combined his passion for technology, business and computer science to create a strong place for MicroStrategy. He became a Bitcoin believer in March 2020, and tells us about his monetary thesis and why Bitcoin is the best Store of Value.

Michael Saylor (MicroStrategy CEO)

Interview Date : 8th December 2020

- Michael Saylor MicroStrategy CEO (All Interviews)

- Where did you go to university, and what did you study?

- What Triggered You to Come into The Crypto Space?

- How Does the Media Write about Inflation Rate?

- Why is governments say “there is no inflation”?

- What is the most important feature of Bitcoin to you?

- Do you put all your eggs in one basket?

- What do you consider as your primary business?

- How did you think about domain names as scarce digital assets?

- What do you think about Other Ethereum and its DeFi space?

- Would you consider diversifying your assets?

- How do you feel about being called the CEO of Bitcoin?

- Do you think you might be influencing the market movements with tweets?

- How did you feel when you did the first Bitcoin purchase?

- Are you planning on Integrating Blockchain technology into Microstrategy?

- How did you research and study Bitcoin?

- What ways are there to make money today?

- What are the monetary layers and settlement layers?

- What do you think about the Japanese economy today?

Michael Saylor MicroStrategy CEO (All Interviews)

Where did you go to university, and what did you study?

I went to MIT and studied spaceship engineering. I have a degree in aerospace engineering. I have also studied the History of Science, and the Scientific Revolution and how they impact an economy and society. After I left MIT, I started a company called MicroStrategy at the age of 24 in 1989. I have been the CEO and the principal shareholder of MicroStrategy ever since for the past 31 years. MicroStrategy is a business intelligence company where we sell enterprise and business intelligence everywhere in the world.

What Triggered You to Come into The Crypto Space?

I observed the Bitcoin space as an outsider up until March 2020. I had opinions about it prior to that point, but I wasn’t very well informed. Someone found a tweet from 2013 where I had tweeted “Bitcoins days were numbered”. After that, I hadn’t thought about it for 7 years. In March 2020, I became passionately interested in it and started to study it intensely. The pandemic and the fiscal response to the pandemic was what triggered me to look at it. If we look at the monetary supply, the M2 monetary supply expanded approximately 5.5% in Europe and the US from 2010 to 2020. Macroeconomists are sensitive and aware of such facts, but I didn’t pay attention. I didn’t think that the inflation rate was not equal to 1%, but here is the big epiphany this year; the government says there is no inflation, and yet everything that you want to buy is 20% to 40% more expensive. The truth of the matter is, inflation is a bogus matrix. Central banks define it as the “rate of price change for a market basket of goods and services that don’t include food, energy nor assets.” What the government has done is by definition created a market basket of things that are just deflationary. If I defined the market basket that included food and energy, it would inflate faster. For example, if foods like a table-sized caesar salad would include food like a table-sized caesar salad that has high energy content food or high variable cost food, the inflation rate would increase faster.

If I included scarce assets like beachfront property, land, or a nice piece of art that’s rare, it would inflate much faster. So, inflation is a vector and there are many kinds of inflations. The inflation rate of bonds is 20%, the inflation rate of many equities is 8%, and the inflation of consumer goods, not including food and energy, is 1 % or less. There even are a lot of things that are deflationary, so if you focus upon the wrong thing you will come to the wrong conclusion.

How Does the Media Write about Inflation Rate?

The media publishes the inflation rate based upon that consumer basket that doesn’t include food and energy as dictated by the central bank. Therefore, it lulls everybody into a sense of complacency. For example, I have had people tell me there is no inflation in Japan even though the central banks in Japan have been expanding the money supply. Yet it’s utterly impossible to buy any nice real estate in Japan. Tokyo real estate is the most expensive real estate in the world, and everybody knows it’s hyper-expensive. An average person would have to work 5 to 10 lifetimes to afford it, and yet they don’t call it inflation.

Why is governments say “there is no inflation”?

Because the government has decided “you shouldn’t want that, and you can’t buy that” and as long as you don’t aspire to it, so there is no inflation. I didn’t understand that and that’s why I had not focused on it before. I started focusing on it in March because things that I wanted to buy started going up in price rapidly, while the government claimed there is no inflation. Looking at the expansion of the M2 money supply, and that equates to asset inflation which you would also call “Cost of Capital”. You could also call it “Inflation”, but it is only inflation in the classical sense, so you have to redefine the market basket to include food, energy, and assets, so let’s just call it “cost of capital”. I realized the cost of capital had tripled. It used to be 5% but now is 15%. In other words, every investment that you own that doesn’t have a yield greater than 15% or more will lose value. This applies to bond yields, stock yields, and even a rent yield of a real estate you have. If a bond, stock, or any business in the market doesn’t grow its cash flow faster than 15% a year, it’s going to lose value. Therefore, if it’s a piece of real estate you are not paying out rent yield greater than 15%, then you are not holding value unless you can get the rents to go up by 15%.

Once I understood that I realized the 300 trillion dollars worth of assets in the world that are fiat instruments are all going to lose value. Those assets will most likely lose half of their value over the next 46~48 months. So, if you wish to preserve your wealth or your purchasing power, you have to find something scarce you can buy. This search eventually led me to find Bitcoin.

What is the most important feature of Bitcoin to you?

The single most important feature of Bitcoin is the fact that it is thermodynamically sound. Bitcoin is a closed thermodynamic system with no more than 21 million coins. You can’t add or remove coins other than losing them. It’s a deflationary system, and all you can do is add energy to it or take energy away from it. So, you can either heat it or cool it down. What is compelling about Bitcoin is that it is the first sound monetary network invented in the history of the world. I view it as a monetary energy network that can collect, store, and channel monetary energy and space over time without power loss. Energy means you could put money in it and hold it for a decade or 100 years. Over space means it’s 1:1000 to 1:10 000 of the energy required to move gold or other sources of monetary energy. Therefore, it is a highly efficient monetary network. That’s what’s compelling.

There is a whole list of things that make it compelling, but ultimately, I feel like looking at 10~20 components will lead to missing the point. The point with Bitcoin is that it is an energy network that is the first engineered monetary energy system. I can convert any form of energy into money, and I can convert money back to any form of energy, so it is the highest form of monetary energy because anything else can be converted to it and vice versa. Thus, every other monetary network is defective. For example, seashells don’t work so well, and neither do commodities, tobacco, gold, silver, and copper. They all are defective because they have leaks. They bleed energy over time.

Gold may be the most famous example of money. However, gold miners create 2% gold every year, i.e., if you store your energy in gold, you are going to lose at least 2%to 4% a year. Over 100 years, you will lose 80% or more of your energy assuming everything else stays the same.

The reason why some people still choose gold over Bitcoin is that they don’t know about Bitcoin. So, gold is the best energy system they can find as the alternative would be the fiat monetary network. Whereas the gold monetary network is losing 2 to 4 %of its energy level every year, the fiat money is losing 5% to 25 %. This is not because gold is good, but simply that the paper networks are awful. The rate of monetary energy loss varies. For example, in countries like Argentina, Lebanon, Venezuela, and Turkey, the monetary inflation rate is much higher than 5% percent. So, if you could put money into gold that is losing only 2% to 4% of its value every year, that would be a better alternative than to lose 10 % of value a year. Gold may look good compared to fiat currencies but it looks awful if I told you “you could lose no value at all”. Bitcoin results in you keeping all your money for over 100 years.

Do you put all your eggs in one basket?

If I am going to lose half of my money, for sure I am putting all my eggs in the Bitcoin basket. Instead of keeping your money in a local currency, you could put it in something that has been going up 100% every year in the past decade. For example, how could it be smart for someone to keep their local currency after letting them know their currency is going to crash by 90%. What would you convert and diversify into other than Bitcoin? In such a case, every piece of real estate, every stock, and bond that is a fiat instrument will lose a decent portion of their value. If you don’t know about Bitcoin in such a situation, you will most probably lean towards gold until you discover Bitcoin. As soon as you know about Bitcoin, you are going to sell your gold and buy Bitcoin as is a million times better. The conventional view on Bitcoin being something volatile and risky, and that you should only put a small percentage of capital into it is not what I believe to be true. My view on Bitcoin is that it is the ideal treasury reserve asset because it is a safe-haven asset engineered to be superior to gold in all aspects. Therefore, if you have something that is engineered to be better than gold, and if you knew you are going to lose half of your assets if you kept them in cash, why would it be risky to put your money into something that is better engineered than gold?

What do you consider as your primary business?

Selling enterprise and business intelligence is our primary business. I myself am a technology entrepreneur as well and have always been very interested in creating new businesses. In the 1990s, I bought several .com domain names such as “Hope” “Courage” “Wisdom” “Strategy” “Angel” “Alarm” “Speaker”, and “Voice”. I bought my name, Michael, and my nickname “Mike”. I bought them because I thought these domain names would make good digital real estate to put a business on. We commercialized one of them, Alarm.com which we spun off. Today, it trades on Nasdaq with a market cap of $4.7 billion. Angel.com was sold for more than 100 million dollars. Eventually, I sold the domain Voice.com for 30 million dollars – it’s the largest amount anybody has paid for just a simple domain name in the world. So, I have always been interested in digital scarcity, technology, and tech investments. I have been a big tech investor in Apple, Amazon, Google, and Facebook from very early on. I learned a lot about their business models for my role as a technology investor. All that along with continuing to run MicroStrategy as the CEO throughout this time.

How did you think about domain names as scarce digital assets?

Everybody in the world is taught to spell the word “Hope” if they learn English. Thus, the value of a domain is a function of which language it’s in. The language that has most business on is English, and the most traffic on the internet is also in English with the dotcom domains. If you own a word that is easy to spell and remember with positive connotations, like Apple, Amazon, etc., it will be very useful. If you own such a word, you can put a business on it. The logic of this is if a billion people see the name and they can remember and spell it, surely, they will be able to type it. If I have a company name that has a difficult name with no positive connotation, people will have a harder time remembering it. Thus, you much rather have it called something simple like “hope” or “wisdom”.

Another important factor is the dotcom domain. If the word that you own is not on the dotcom domain, it falls off in value. People have a harder time remembering it if it was dot io, dot org, or dot tv. Moreover, if the word is too long, it falls off in value too. If 65%~ 80% of the money on commerce around the world is in English, and if you own one of the 1000 most important words in the English language, you can treat the domain as a business. For example, imagine what Apple would pay to get Apple.com today. If you own that word, then you are owning an asset similar to digital real estate. It’s like owning a block in Manhattan, the biggest city in the world except if you own a precious domain name, it’s like owning the central block in every city in the world.

What do you think about Other Ethereum and its DeFi space?

I didn’t invest in Ethereum. If you ask me “Is Ethereum risky?”, then the answer is “yes”. Ethereum is not Bitcoin, and it is much riskier than Bitcoin because it is complex. I think you can’t lump them together. When you create software or a crypto network, you have to decide what you are designing it for. Ethereum is designed to be much more functional and complex. Thus, there are many more attack surfaces which means hackers have more surface areas to hack it. There are many more moving parts, so it can break more easily. Would I invest money in Ethereum? No. Why? Because it’s risky. . All the other crypto coins are akin to venture capital experiments, and they have a much greater risk to them. Some will succeed and some will fail. The more complexity there is, the more functionality there is, the more attack surfaces there will be. That’s why I think one of the key benefits of Bitcoin is that it’s simple and it’s hard to change. Also, it’s not that functional. For Bitcoin to be successful, it doesn’t need any additional functionality anymore as it is already complete. The most important feature of a crypto asset network is immortal sovereignty. Immortal sovereignty means that it needs to be bulletproof, has to last forever, and it needs to function outside the constraints of a nation, state, or company. Moreover, the indispensable function application of immortal sovereignty is a store of value as value is energy, and energy is money.

Would you consider diversifying your assets?

It’s a lot riskier if you invest in a hundred different crypto networks than putting it in the one which is the least risky. You might very well lose 99% of your money if you diversify. Diversification is selling winners to buy losers. For example, if you own Amazon stocks, why would you diversify that with other retail company stock? Amazon destroyed 15000 retail companies. If Amazon is going to destroy all the other retailers, I will lose all of my money if I diversified. It’s less risky to buy the winner. The same theory applies to Google and Apple. Apple became so successful that it generated 150% of all the profit of the mobile phone industry. In other words, Apple made money and every other company in the industry lost money to compete with them. So, if you were to diversify and sell Apple stock to buy something else just so you don’t have all your eggs in one basket, you would be selling the winner to buy the loser. Instead of having a million dollars in Bitcoin, I would lose value by storing it in fiat. That isn’t diversification.

How do you feel about being called the CEO of Bitcoin?

Bitcoin has thousands of CEOs. I am one of them out there advocating. I am doing those things that I can do under my domain, but the CEO of Grayscale, the CEO of Coinbase, and Binance, Square, and Paypal are all advocating too. There is one CEO talking about Bitcoin every morning, there is another one in the afternoon, and I assume there is probably a CEO talking about Bitcoin in Japan just like there is one in Korea and Germany. That’s the way it should be. So, I am one of many but I think there is a swarm of CEOs, and that’s what makes it insanely great. There are so many passionate leaders everywhere thinking about space and advocating, and I am happy to be part of the team.

Do you think you might be influencing the market movements with tweets?

I don’t, and nor do I try to influence anything and anybody. I focus on the long term, and I don’t think it is possible to figure out what price will do in the near term. I don’t even worry about it. For me, the short-term is 3 years, the mid-term is 10 years, and the long-term is 100 years. The market will do whatever it’s going to do. When we bought Bitcoin, I was prepared to be wrong for 3 years if I had to be. However, I thought it was the right thing to do at the right time.

How did you feel when you did the first Bitcoin purchase?

When I first purchased, I was relieved, and I felt like the world would be a better place. I thought my company would be more successful because I think about Bitcoin as “hope”. I own hope.com and I have turned it into a Bitcoin information page. When you have Bitcoin, you have hope, so I was happy.

Are you planning on Integrating Blockchain technology into Microstrategy?

We are running a full Bitcoin node right now. We are extracting the blockchain, studying the data, looking at our business, and are trying to consider how we might be able to add value. We don’t have any concrete announcement in that area but we are researching it, and if we can find some constructive way to bring value with our software to Bitcoin, then we will.

How did you research and study Bitcoin?

Most of my research was done on YouTube and I learned a lot from Andreas Antonopoulos. I also watched Bitcoin debates by Erik Voorhees and Peter Schiff, Pomp podcast, I also read the Bitcoin Standard by Saifedean Ammous, I watched, and I read Vijay Boyapati’s “The Bullish Case for Bitcoin,” Parker Lewis’s writings. So, I have been through a variety of writings and videos.

What ways are there to make money today?

I think that you have to tap into large waves of technical change taking place today. We are living through the virtual wave right now. In the virtual wave, it is now possible for us to zoom anywhere to the speed of light and bend time and space. The speed of light can be defined by 2 people who are each in a different corner around the world, interacting through Zoom. Before the pandemic, it didn’t happen as much as it has increased exponentially in 2020. This year I started talking to people from Australia, Germany, and many other countries.

However, bending time and space can be described as a video recording that is watched anytime wherever by anybody. Just like this, bending time and space in a business to create opportunity is important. This could be arbitraging labor that is available in one part of the world to provide a service in another part of the world. Or, finding a way to automate something that used to be done manually, and do it 100 000x cheaper by streaming a video for example. Such virtual aspects can be found in every single part of the market today in various forms.

What are the monetary layers and settlement layers?

In the finance world, the best opportunities are tapping into the finance transformation as people convert fiat investments into crypto investments. Bitcoin is the fundamental settlement layer and monetary layer. Its monetary network offers people to plug into it. Some people plug into it by becoming miners while others build exchanges, which is also very important. Then you have a payment network like Square and Paypal who are plugging in through creating a settlement layer. Besides, there are analysts, as well as more sophisticated financial instruments in the crypto space. At some point, life insurance policies, debt, yield, banking and other sorts of derivatives will plug into it because the market is evolving.

In a world of 7.8 billion, people are going to lose half of their wealth in the next 46-48 months if they don’t convert it into something like Bitcoin. To me, it seems that is a pretty big driver of business opportunity if you can solve that problem. However, solving that problem means you have to solve it subject to all sorts of regulatory compliance requirements in every country on the planet. It is not only every country but different between states in the same country as well. For example, if I want to trade derivatives of Bitcoin in Florida, regulatory bodies in Florida may respond by “you are not allowed to do this if you are a Florida resident”. However, if you were an Ohio resident, the Ohio governmental body may say “you are allowed”. So, not only am I not allowed to do it if I am in the wrong country but, I might be living in the wrong state. Therefore, an idea of how to solve and change the regulatory tax compliance constraints, allowing people to do what they want to do could be a major business opportunity right now.

What do you think about the Japanese economy today?

I think Japan has the same challenges macroeconomically as every other country has. It has undergone a very aggressive monetary expansion by the central banks. The Japanese banks own a great deal of the equity but have a lot of the national debt as well. They are expanding the money supply, just like the EU and the US federal government are. The number one & overarching problem in this situation is assets are over-inflated and there is a lack of price discovery in the market. The capital markets have frozen including the markets for bonds, stocks, real estate, etc. All of those asset values are inflated such that the average person cannot work and make enough money to buy them. As the price of all these assets go up, and the wages are flat or going up much slower, it freezes a whole class of people out of being able to buy assets. Consequently, there will be no asset trading because you will have zombie companies and zombie assets that create economic inefficiency. This has been the situation in Japan for a long time now, and it’s starting to become a problem in other countries in the world. We have to find ways to deal with it, and the best way to deal with it is to adopt Bitcoin as the solution. As monetary energy flows out of those assets where there is no price discovery anymore, people will eventually become aware of it, and logically start to sell their overvalued assets to buy Bitcoin. As they sell their assets the monetary energy flows into a more perfect monetary network leading price discovery to return to all the other markets. As a result, you will be able to afford to buy things again. The best way to make it happen is to grow the exchanges, and educate everyone to make it easy for them to acquire Bitcoin.

We are not traders, and we are not trading with Bitcoin. We are not gamblers not speculators, and we are not macroeconomic traders. Most traders are very technical and have models of how they think the price will go up and down. However, we have another view on that which is, there are 300 trillion dollars of assets in the world, and half of the wealth in the world is going to get drained out of those assets by the central banks over the next 46-48 months. Thus, Bitcoin is a safe-haven for us, and we are long term convinced that Bitcoin will become more valuable, the network is going to absorb monetary energy which means that any time is a good time to buy it. I don’t think you are ever going to sell it. Why would you ever sell it if the alternative you are going to buy is defective?

It is like being in the north pole, and it’s getting colder day by day. If you see a heated igloo you will want to enter instead of freezing to death. Assuming there is only one igloo, you enter the igloo. There is no point in thinking like those people saying “ do you think you paid too much to get into the igloo?” I didn’t want to freeze to death. Besides, as it gets colder, other people come in too, and they may pay a higher price to get it. “When are you going to leave the igloo?” is a question that I would never pay attention to. I am never going to leave the igloo because it’s freezing outside. Why would I leave heat? It does not matter if you paid some extra dollars for the ticket. I get up every day thinking about how I can make the world a better place. For me, Bitcoin is as important as running water, electricity, airplanes, steel, railroads, and oil networks. Most people have yet to understand that, so I am simply interested in evangelizing and building the Bitcoin monetary network.

Interviewer , Editor : Lina Kamada

【Disclaimer】

The Article published on this our Homepage are only for the purpose of providing information. This is not intended as a solicitation for cryptocurrency trading. Also, this article is the author’s personal opinions, and this does not represent opinion for the Company BtcBox Co.,Ltd.