We are excited to share this interview that we had with Patrick Mueller from Coin ATM Radar. He talks about their ATM Radar service, and about the different roles of operators and providers. Please check it out to see where the nearest Crypto ATM is located from you.

Patrick Meuller (Coin ATM Radar )

Date :9th March 2020

- Coin ATM Radar Patrick Meuller (All interviews)

- Use Cash one Side of an Exchange

- ATM Net Change and Crypto ATM Gauge

- How important is location for the ATMs

- Lightning ATM are as of yet not Adopted at ATMs

- ATMs will Increase in the coming Years

- Money Laundering is more likely to happen with Traditional Financial Systems

- Challenges we are Striving to Solve

Coin ATM Radar Patrick Meuller (All interviews)

Use Cash one Side of an Exchange

Coin ATM Radar is a service for both website and mobile apps, to make easier searching for places to exchange cryptocurrency for cash and vice versa. We concentrate only on listing services that use cash on one side of the exchange transactions.

The majority of businesses listed on our website are bitcoin ATM companies, or more generally cryptocurrency ATM companies, because many ATMs support other cryptocurrencies as well. Bitcoin ATM is a dedicated machine, and sometimes looks similar to a normal bank ATM, sometimes not, which allows to buy cryptocurrency with cash, or sell cryptocurrency for cash. There are also other services listed with us, where one can come and buy bitcoins through a cashier desk.

We do not operate the Bitcoin ATMs, but we have a list of ATM providers who run them.

Just to eliminate a often misunderstood fact; we don’t sell these devices, nor have we collaborated with manufacturers. The market has many players, but two major roles are manufacturers of ATM, who produce hardware kiosks, and more importantly develop and maintain software. They sell these devices to operators, who run them as a business. So operators are those who buy kiosks and operate later, which is a totally different business model compared to manufacturers.

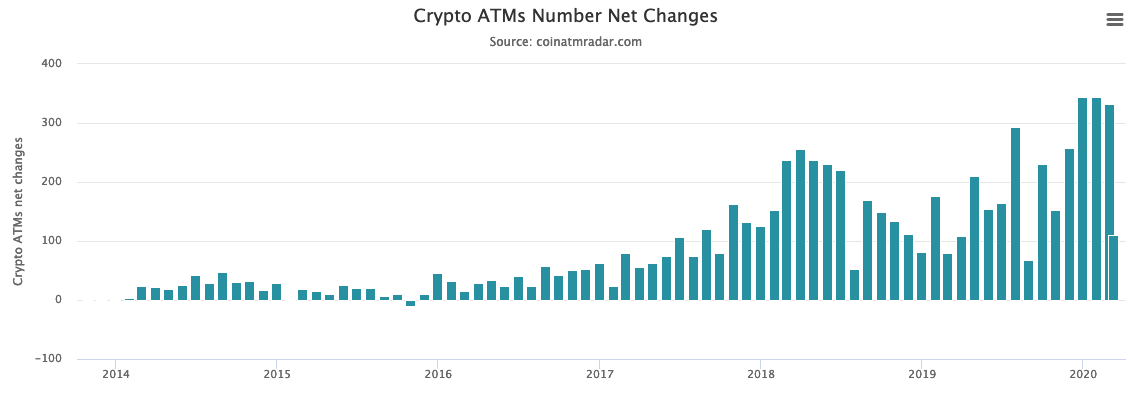

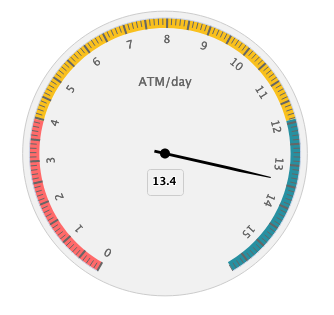

ATM Net Change and Crypto ATM Gauge

The above chart shows how many new machines were installed over a month. It is called “net” because it takes into account closed locations as well. So it reflects pure growth of ATMs.

The above shows new installations of machines in a gauge chart, so more like a speed bar of installations. Also the scale for the chart is calculated based on a 2 month period, while number of machines installed is daily average over last 2 weeks.

How important is location for the ATMs

Selecting a good location is one of key aspects of running a successful business. There are many cases when operators closed ATMs for being not profitable and moved machines to another locations. Location needs to have following characteristics to be successful:

Firstly, the ATMs have to be positioned in a well located place, like near interstate roads, with easy access and parking preferably. As of today, the customers of ATMs are mostly not the ones who randomly see an ATM and do a transaction, usually it is the case, when customers need to buy or sell cryptocurrencies and then they search for nearest location. We have a dedicate page for finding closest bitcoin ATM on our homepage. Once they find it, sometimes people are ready to travel 1-2 hours to the nearest machine with best conditions.

Secondly, certain shops or locations need to have good opening hours, e.g. 24/7 is probably the best, also accessibility on weekend is important. Also, in general locations need to be in an area with high demand for such transactions. We advise new operators to get a field research, e.g. attend local bitcoin meetups, and check what is the interest in this or that city before installing machines.

Lastly, location needs to be well positioned in the store, e.g. placing an ATM at the very entrance might be not recommended. Bitcoin ATM users value privacy and it makes sense to find a place inside, where they will feel comfortable, that nobody looking at the screen from behind them.

Lightning ATM are as of yet not Adopted at ATMs

As of now, Lightning Network is not really adopted at ATMs. There is a manufacturer – General Bytes, who added support for LN in their software officially. All the other major ATM providers have not added it yet due to lack of demand and lack of liquidity in the network itself. But in general, all have intent to do so.

We have a good article on how Lightning Network ATM is different from bitcoin ATM that does onchain transactions: there are some pros and cons compared to ATMs that we see today.

ATMs will Increase in the coming Years

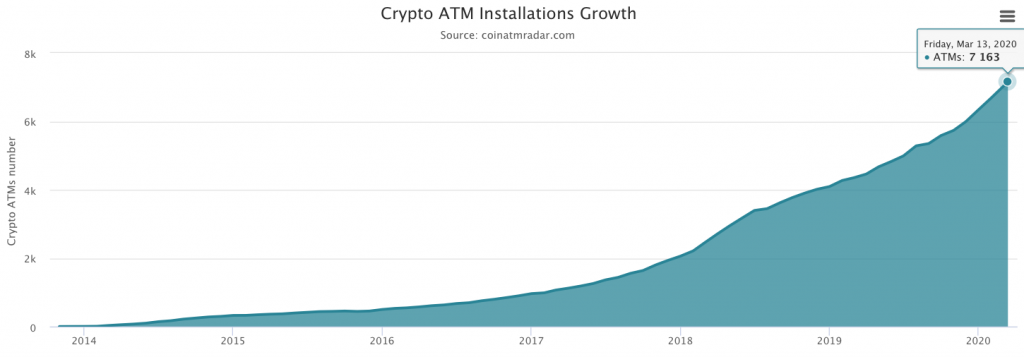

We do believe that ATM numbers will continue to grow over the years. At the moment, the cryptocurrency world is still very isolated and there is no circular economy; this means that users who own cryptocurrency need to exchange it first to fiat in order to make everyday transactions. Speaking about the scope of exchanging cash with cryptocurrencies, ATMs play one of the biggest role. Also there are many large scale operators who do this as a profitable business and plan to install hundreds or even thousands of new machines. Today we have a little more than 7000 crypto ATMs worldwide, so we are still at the very beginning. Looking at the past history of installations chart,it is seen that growth is not linear, and so we expect this trend to continue.

Money Laundering is more likely to happen with Traditional Financial Systems

The operators who run ATMs need to follow local regulation, which includes KYC/AML policies in place. In different countries, thresholds are different. Up to some volume it is usually possible to trade without doing KYC and this is very important for privacy of many people, for larger volumes customers might need to register with operators. All major manufacturers have functionality for KYC procedures, each operator needs to enable a set of features they need or disable the ones they don’t need.

It is important to understand that you hardly can launder money with $200-500 limit. Actual laundering of money highly likely happens with traditional financial systems within banks and on a totally different scale. Requiring full registration starting from amount 0 doesn’t make much sense, and brings more issues to users. Keep in mind that there are more than 500 operators worldwide, and when user needs to scan their documents (passport scan or ID card), this information is stored by operator. How the user is supposed to know how securely this data is stored and not leaked at some time in future. Many operators close activity, and the reasonable question — what happens with all data that was collected. So we usually recommend to keep KYC requirements as low as it is legally possible in the area where ATMs are operated.

Challenges we are Striving to Solve

We try to constantly improve our services, which includes adding new functionality on the website and developing both mobile apps to make search for people easier. One of the recent challenges was how to display the cheapest ATMs because there are various commissions operators charge, e.g. % commission on top of market rate and also flat fee per transaction.

In the past we had algorithm that was sorting cheapest locations using only percentage fees, however, some operators took advantage of this and were setting fixed fees as large amounts, like 10-15 USD per transaction. In the end they were shown on top of lists, because they charge relevantly low % commission, e.g. 5%, but due to high flat fee their effective rate was much higher. For example, if you buy $100 in bitcoin and you pay 5% commission + $15 as a flat fee, you end up paying 20% in total. Now this is fixed and we take both fees into account, however, many operators (especially those who have higher than average market fees) disable reporting.

Our main target to help users find locations where they can securely trade their cryptocurrencies. We list various coins on the website, e.g. both BTC and BCH are listed. We have ETH, Dash, LTC etc. Every user can find a location that best fits their use-case. Crypto ATMs are still one of the most secure ways for exchange using cash. Another option to meet someone and do a trade in person, but then there is much higher risk of getting into problem compared to using ATM from an established business. So the main goal we try to achieve is help people to stay secure and private as cash transactions are considered more private than for example a transfer from a bank to exchange irrespective of controversies that may happen.

【Disclaimer】

The Article published on this our Homepage are only for the purpose of providing information. This is not intended as a solicitation for cryptocurrency trading. Also, this article is the author’s personal opinions, and this does not represent opinion for the Company BTCBOX co.,Ltd.