Alessio Rastani has worked as an independent trader and in the research of the financial markets for over 10 years. He has become a widely followed commentator, releasing countless videos, reports, and online educational material on subjects such as trading and the technical analysis of stock markets, crypto, forex, etc. He started his career as a trader after the crash of the famous dot-com technology in 2000. Chart Analysis for both the stock market and the crypto market is one of his specialties and favorite topics. He Has been invited to many seminars and events, including to the TEDtalk stage, to speak in London, USA, the Netherlands, and Hong Kong.

Alessio Rastani

Interview Date : 29th June 2020

- Alessio Rastani (All Interviews)

- A Push That Kick Started My Career

- Ultimate Fail lead to Long-Term Trader

- A Dangerous Parabolic Trend

- Bitcoin’s Trend Today

- I don’t Follow Financial News

- Aviation Industry is Suffering Hard

- From Law to Trading

- Potential Is There for Altcoins Too

- Being a Contrarian pays off

- Markets can Humiliate You

- Uncertain Monetary System

- Decentralized system more than Centralized

- Books on How to Trade and Invest

- One Idea is Enough

- Chart analysis Learning

Alessio Rastani (All Interviews)

A Push That Kick Started My Career

My career as a trader started by holding an interest in the stock market in the early 2000s. I met a guy who worked for one of the biggest firms in the world the Goldman Sachs, a fantastic guy and now a good friend of mine. He was the one who got me into the stock market. He taught me some trading strategies, and it all started from there. Then I started researching the stock market and made a ton of mistakes. Before the 2000s, I lost a lot of money, around 50,000 dollars.

Alessio Rastani

This was back in the late 1990s, and to lose that amount of money as a student with money that I had received from my inheritance, became a huge learning lesson. In the late 1990s to the early 2000s, the bitcoin of back then was the dot-com stocks. We had the dot-com internet bubble, which was a different kind of environment than today. The dot-com internet bubble was the new thing just like bitcoin has become the new thing now. People were crazy about dot-stocks, and I was crazy about it too. I make some terrible investments in internet and dot-com stocks. I told myself that I give it up forever, or I can start learning about it. I decided to do the later, and that is how I come to be where I am today.

Ultimate Fail lead to Long-Term Trader

I don’t trade short term, I am not in bitcoin in the short-term but in the long-term. That is the same strategy that I use in the stock market too. I don’t do day trading and swing trading either. It saves more of a position trade, you are in something for 2 weeks but rather for years.

When I first heard about Bitcoin back in 2013, it became an embarrassing moment for me. I did an interview with Peter Schiff and Brian Rose, and in the interview, I made the embarrassing statement saying that in a few years no one would talk about bitcoin. It is the ultimate video to fail.

A Dangerous Parabolic Trend

A lot of people, including me, thought 1000 dollars on bitcoin was expensive. Who would have thought it would go to 10000 dollars, and eventually to 20000 dollars. However, that was a bubble in 2013 in the sense that the price became parabolic. People often misunderstand the term “bubble”. Many have the misconception that it means “expensive”. Although a bubble can indeed mean the price of a good gets expensive during the short term, that is not what traders mean with it. When traders use the word “bubble”, they mean the price has accelerated parabolically. When something becomes parabolic, it becomes dangerous.

When I first got into Bitcoin, there was a small bubble in the price. The price eventually went up to 1000 dollars and collapsed again. Eventually, it went back up. That was when I started to talk about bitcoin, and I went from a bitcoin skeptic to someone who realized that I was probably wrong about it. I started to analyze bitcoin and took it more seriously. A few years later, I started making videos about it as well in 2017. In 2017, I started with bullish videos about bitcoin, but when the parabolic phase occurred, I started making bearish videos. I started saying Bitcoin had become dangerous when bitcoin went from 10000 dollars to 20000 dollars, and that we needed to think about this market as it is going to collapse.

Bitcoin’s Trend Today

Bitcoin has recently been in a messy sideways range for many weeks and months. Bitcoin is probably at the beginning of a LONG TERM wave 3 in the Elliot wave.The Elliot theory is like the Russian Babushka dolls; When you open one doll, there is a smaller one inside, then you open that one, and there is an even smaller one inside, and so it continues until the last tiny doll ha been opened.

The Elliot wave theory resembles that as it is about understanding what the trend of the market looks like. It explains the market is composed of five waves where each wave is composed of smaller waves inside of it.

Ever Since the second wave ended from the rally in March, I think Bitcoin has started and is at the beginning of an uptrend. This will be the start of a major up-trend. My target for Bitcoin eventually for the next few years is the higher 30~50 thousand range (although some consider this to be a conservative estimate).

So, we are only at the beginning of this up-trend, and I think that, at this moment, we are just entering the start of the new big wave 3 of the uptrend. Before getting to wave 3, there will be a market correction again as we end wave 2. The price of Bitcoin will go up to around 12000 dollars one more time, then there will be a correction in price down to just below 10000 dollars (10K), but that will be the last time we will be in the 10K dollar range. From there, we are going to go to even higher levels in the next few years.

I don’t Follow Financial News

I am not a huge fan of financial newsletters or media at all. I don’t find it particularly useful, but I find sentiment analysis very useful. There is a guy out the whose name is Jason Goepfert, who is a sentiment trader. His research is really good. However, I do pay attention to what other newsletter writers are saying, purely for one reason; often, there could be contrarian indicators. Sometimes article writers of these financial journals and media, who will write in extremely pessimistic tones, that often, is a contrarian indicator. There also are journalists who write in extremely optimistic tones as well. So, I go to a news site and just count how many positive and negative articles I can find on bitcoin. The more positives articles you see would be a good contrarian. However, if you see a lot of negative articles with very negative views on bitcoin, and other cryptocurrencies, then you can use them to your advantage. That could indicate we are reaching a turning point in the price.

Aviation Industry is Suffering Hard

I think the aviation industry and the restaurant industry are going to struggle hard, although it all depends on how the virus situation is going to play out. Some people say it will be over by next year, while others say it is not going to go away. Nevertheless, until a vaccine is developed, and we finally see infection numbers go down, we are going to see the airline and restaurant industry do badly and struggle.

However, the industry is not the same as the stock market. You might see airline stocks and the restaurant stocks pick up an uptrend in the next few months, but the industry still might be doing poorly. That is because the market, the price action, is different from the economy.

I am interested in looking at the charts of aviation and restaurant stock charts, to wait and see if an uptrend develops. Let’s take the company Boeing, for example, which is a huge company. I dislike Boeing because they received a massive bailout from the government. I don’t like that, because if a company is failing or is in trouble, it should not go to the government asking for a bailout. It is corporate socialism if you think about it. Other Airlines have also received massive bailout as well all over the world.

Anyways, as far as stocks are concerned, I think that Boeing is something that I am very much interested in to see if an uptrend develops. Once I see an uptrend develop, I am a buyer. We have to be careful here because some of these airlines are going to go bankrupt. I don’t know which ones, but the smaller ones are more likely to. If you see an airline stock price goes below 1 dollar, it will likely go bankrupt. I wouldn’t touch any stock that goes below 1 dollar as it is very likely it will go down to 0. One has to be careful even with stocks that cost 5 dollars because once a stock goes below 5, it could quickly get momentum towards the 2 ~ 1 dollar mark. The aviation industry, especially, will suffer a lot as will scale is decreasing in the coming years.

From Law to Trading

My academic background is actually in Law, so it has nothing to do with finance. It was a bit of an accident that I went from law to trading in stock markets and chart analysis. The investor-friend of mine from Goldman Sachs really inspired me to learn about the markets and trading. Now that I look back, I am actually glad that I left my original profession, Law. Even though I enjoyed the legal profession, I don’t think it would have been the right one for me to stay in for the long term.

Potential Is There for Altcoins Too

Not only in Bitcoin, but I am also a huge believer in Altcoins. I cannot say that I am an Altcoin expert, and there are people out there that know much more about it than I do. However, I have looked at the markets, like Ethereum, and I also like XRP and NEO. I know some people hate those Altcoins, but I am not a Bitcoin maximalist. I think that there are plenty of opportunities within Altcoins as well, and it is good to keep an open mind. I was looking at some

Being a Contrarian pays off

I started youtube by coincidence. I originally started a travel vlog, and it was supposed to be only for some of my travel videos until I realized I wasn’t that good at it. So, I decided I wanted to go and do other kinds of videos, and since, I started posting videos about chart analysis. I made a video predicting that Bitcoin was going to collapse, and at that time, Bitcoin was around 10000 dollars. I never imagined Bitcoin going from 10K to 20K in a week or two. So, it was a surprise to me, but that rate did not last either. However, When I posted the video before the collapse, a lot of people were angry at me for saying that the Bitcoin bubble would burst. Eventually, it did burst. I noticed that often when you do a contrarian video on youtube when you say the opposite of everyone expects, you will get a lot of blow-back. People will say things like “you are crazy” or “you are wrong”, and it is going to cause a lot of anger in some people, and I understand that. But, I think it pays to be a contrarian. Usually, when the majority of people say “Alessio, you are wrong”, and they get aggressive, I like that because it shows that there is a fear of what I have predicted actually could be right.

Markets can Humiliate You

It is very hard to be an independent trader and to do market analysis because the markets can change within a day or a week, and the prove you wrong and humiliate very quickly. Something you said a week ago could prove you wrong by the next day or week. This is by far one of the most difficult professions to be in. If you want to be a chart analyst or a trader, you need to be open to possibilities, and you should never get too comfortable in any position. Thus, being open to change your strategies、 and to change your mind quickly is important. The people who are not good at this job are the ones who are reluctant to change or admit that they were wrong about something. You see those Gurus on TV, who unfortunately are so full of their ego that they don’t realize the market can prove them wrong very quickly. So, you need to be humble in this profession, and if you do a forecast that turns sour, you shouldn’t take it personally and just move on.

Uncertain Monetary System

I don’t know how the monetary system will evolve from this point. I think that economists who have predicted a monetary crash in the near future are right, and it is going to happen in the next few years. The crash in March this year was the biggest one everyone was expecting. However, what happened in march brought us to a market bottom and we could go much higher in the stock market and Bitcoin as well, but that was not the economy crash of the monetary system that we are talking about. I do think that a bigger crash is waiting ahead of us.

Decentralized system more than Centralized

The people who truly believe in crypto think this is a generational change that will be with us in the future, and I agree with them. There is a fundamental case to be made, don’t just be involved in fiat currency, but be involved in edgier bets like gold, silver, and cryptocurrencies. When I hear people say Bitcoin will go to 0, I am skeptical about that. I don’t think that is going to happen. Is it possible that it may happen? Yes, it is, but it is very likely. Eventually, governments will find a way to live with Bitcoin rather than getting rid of it.

However, even though we know that cryptocurrencies and digital currencies are the future, we don’t know which currency will out-survive everything else. Maybe it will be Bitcoin, but if not, it will at least be a digital currency. In the same way that the internet and dot-com changed the world 20 years ago, the same phenomenon is happening with Bitcoin. It is a generational civilization change that is happening, so I am a bull on Bitcoin in the future.

Books on How to Trade and Invest

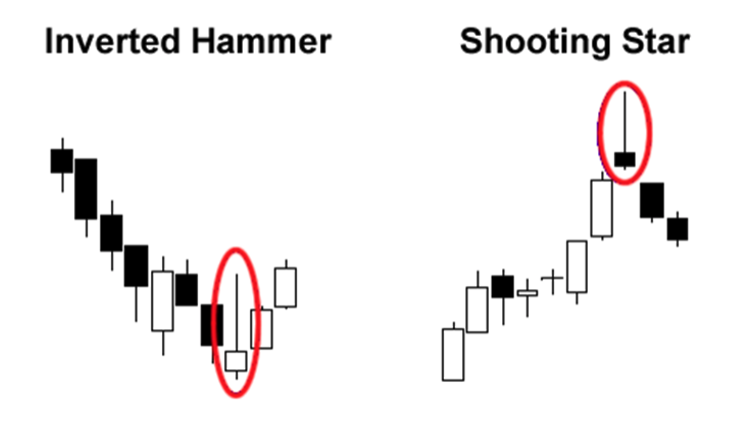

One of the books that I would recommend for learning how to read charts and for trading is Japanese Candlestick charting Techniques by Steve Nison. You do not need to know every single Japanese candlestick pattern method. The ones that I use the most are Hammer, Shooting Star, Bullish engulfing patterns, and the bearish engulfing patterns. So that is a great book to start with.

One of my favorite traders is Linda Raschke, and she has published a book named Trading Sardines. I also like Trading in the Zone by Mark Douglas is a great book for those who want to understand the psychology of trading. I stand by that book, it’s fantastic.

One Idea is Enough

I don’t use every single tip or advice from all the books I read. Sometime when you read a book, there will be one particular idea that will stick with you that will be useful. For example, I don’t use any single pattern from the Japanese chart analysis book. I don’t think that it’s necessary, or even useful, as reading one too many formula analyses can cause analysis paralysis. You may come to a point where you over-analyze something to its bottom with no meaning left behind it anymore.

When I first began to learn Chart analysis and trading, my friend who worked for Goldman Sachs, taught me some of his favorite strategies. His favorite strategy was the Shooting Star and the Hammer Candlestick Pattern. We would plot on the chart. He would say “ you wait for an up-trend in the price in a market, then you look for the price to pull-back to support like a 21-day moving average, and wait for hammer candlestick patterns. When the hammer candlestick patterns would form, and so a break about that hammer candlestick pattern would be a buy, and the opposite applies to shoot star pattern. So that is one strategy that has been very useful to me for a long time.

Chart analysis Learning

There are a couple of good books out there on Bitcoin, one is Dominic Frisby but it is a couple of years old now. However, if you want to be in the Bitcoin and crypto sphere, you really should just immerse yourself in the industry. You can do so by doing chart analysis and looking at price actions, and practice over and over again. You have to continue to learn about the markets and trading because you never stop learning. Moreover, the markets are changing now and then. Even the patterns change, so you want to learn those new patterns and how the markets are evolving.

Interviewer , Editor : Lina Kamada

【Disclaimer】

The Article published on this our Homepage are only for the purpose of providing information. This is not intended as a solicitation for cryptocurrency trading. Also, this article is the author’s personal opinions, and this does not represent opinion for the Company BtcBox Co.,Ltd.

Please pay attention to the following points when trading cryptocurrency.

(1) Cryptocurrency is not the legal currency that is supported by the government such as yen and US dollar. It is an electronic data on the Internet.

(2) The price of cryptocurrency may fluctuate drastically. There may be a sudden drop or loss of value, and you may suffer losses.

(3) The cryptocurrency exchange needs to register with the Financial Services Agency and the Finance Bureau. We are a chartered cryptocurrency exchange (Charter Number: East Japan Local Finance Bureau No. 00008).

(4) When trading with cryptocurrency, please read the explanatory documents (The terms of use, etc.) on our website and decide for yourself whether or not to conduct a transaction.