Robert Breedlove is the founder and CEO of Parallax Digital. He started investing as a hobbyist in 2014 and that hobby turned into a profession. He formerly operated crypto asset hedge funds. He started to get out of the role as a fund manager in 2020 to focus more on Bitcoin consulting. He still does some advisory work for a number of Bitcoin companies, including hedge funds and early-stage equities. More recently, he has been writing about Bitcoin, the history of money, economics, the deeper philosophical impacts of Bitcoin respective to the socio-economic effects it has on the world. (YouTube Twitter Medium)

Interview Date : 24th December 2020

How has the narrative of Bitcoin changed?

I have been investing in the crypto asset space since 2014, and that became more of a profession in 2016-17. Since, the space has matured a lot, and we have seen many of the larger traditional financial institutions have become more integrated with the cryptocurrency ecosystem. Back in 2014 up until 2016 Bitcoin was considered “a joke” or “a scam” by most people. That narrative has quickly disappeared today. There are not many intelligent investors left who would tell you that Bitcoin is a scam or a Ponzi-scheme with a straight face. People could perhaps be bearish on Bitcoin’s value proposition, but it’s pretty clear at this point that it’s the most universally transparent and predictable money in history.

What do you say to those calling Bitcoin a Ponzi-Scheme?

I have argued those that have called it a Ponzi-scheme stating that Bitcoin is, in fact, an inverted Ponzi-scheme. Because a Ponzi-scheme comes with promises of high rates of return and low rates of risks, it preys on investor ignorance. Thus, it prays on the ignorance of risk and rewards being two sides of the same coin. So, a Ponzi-scheme prays on people who don’t comprehend that.

In contrast, Bitcoin is the inverse of that in every characteristic. It offers no rate of return, it has no yield, it has extremely high risk, and it is probably one of the most volatile assets in the world. It energizes an investor to become educated on Bitcoin and the crypto sphere as it wants you to comprehend the functionality of Bitcoin. Bitcoin makes you ask fundamental first principle questions like “what is money?” “What is a government?” “Why is society structured the way it is?” and people describe this as the “Bitcoin rabbit hole”. This portal of deeper questions, elucidation, and inquiry that result from interacting with Bitcoin is an inverse Ponzi-scheme. And, I think the world is waking up to this now.

Should I be Scared of Bitcoins Volatility?

Volatility is a natural function of price discovery. The smaller an asset is in the broader market, the more volatile it tends to be. If an asset has less market depth, the bid-ask spread will tend to be wider, and the total quantity of buyers and sellers tends to be shallower. A real glaring example of this is Amazon. If you look at Amazon in the 2001 dotcom bubble burst, it collapsed by approx. 94%, but since then, it has rallied in 2020. In that rally since its early 2000 to 2020, it experienced multiple double-digit drawdowns along the way, but volatility tends to move inversely to market capitalization: the larger the market, the deeper the pool of buyers and sellers creating a narrower bid-ask spread that results in a less volatile asset. Bitcoin is following a similar path to Amazon. Its volatility has contracted as its market cap has grown, and you would expect that this would continue. The interesting thing about bitcoin in terms of its volatility profile is that today, it is considered one of the ultimate risk-on assets, meaning that investors want to hold bitcoin as a risk-seeking portion of their portfolio. This is interesting because Bitcoin’s fundamental value proposition is to be the ultimate risk-off asset one day, a safer haven for value storage than even gold.

In what positions does Bitcoin stand in with respect to Gold?

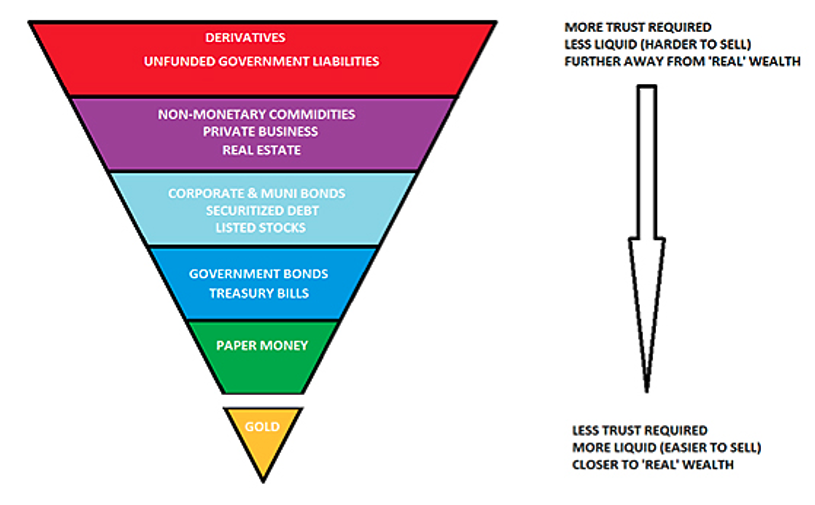

So, we are talking about something that’s actually disruptive to gold. If you look at Exter’s inverse pyramid, it shows more trust-minimized forms of wealth exhibiting higher liquidity making the asset sell easier at the bottom of the pyramid. Gold is the best asset according to Exter’s pyramid, but other assets can work their way down the pyramid. The higher up the inverse pyramid, the less liquidity and thus there will be more risk just like we are seeing with derivatives. Through Exter’s pyramid, we are seeing Bitcoin descend through it going from the risk-on position sinking down as its market cap grows towards gold, and ultimately being disruptive to gold as the ultimate risk-off asset.

Bitcoin is the ultimate positive black swan, and markets are heavily discounting it. Bitcoin is only 12 years old, and there are still some technological functions of this black swan that have yet to be understood or discovered. There might be something with the protocol or some details of its functionality that we just haven’t grasped. Gold has a 5000-year-old track record as a trust-minimized store of value. So, the market needs time to digest the new information about the technology. And frankly, there is not any direct comparison to Bitcoin. We have never had an absolutely scarce amount of money in existence. It’s not corporeal nor tangible, but it’s pure information. Hence, trying to surpass the king of money gold will take a bit longer than 12 years.

What are the properties of Money?

Money needs to satisfy 5 properties. It needs to be divisible, durable, recognizable, portable, and scarce. These are the first principles of money, physical money is riskier in the domain in that it cannot adequately fulfill those 5 properties in the same way that digital money can. So, my strong argument is that so long as Bitcoin continues to exist and operate in the virtually flawless fashion it has for the past 12 years, adhering to its 21 million supply cap, and churning out global consensus every ten minutes, it is actually disruptive to gold.

Will future technological innovation be disruptive to Bitcoin?

I disagree with the people that argue about the new crypto assets or technology innovation in the future could become disruptive to Bitcoin. I believe they have not taken their thinking to the first principles of money. I would challenge people by asking “what do you think the properties of money are?” and “why is there an asset that could be superior to Bitcoin?” Unless they name all the Austrian economic principles of money, then they are wrong. The other aspect that people fail to account for is that Bitcoin is capable of absorbing market-proven features from competitive crypto assets. For example, if Ethereum or any other crypto asset establishes a feature that the market decides as valuable and worthy for incorporation into digital money, Bitcoin can absorb and adapt. Bitcoin is an open-source technology. It has the ability to adapt to beneficial changes while at the same time has the asymmetrical governance necessary to resist harmful changes. That makes it very difficult to introduce a differentiating factor that would outcompete Bitcoin in the marketplace. You just have to listen to the market at this point. The market of Bitcoin is valued around 400 billion dollars today. Typically, when networks like this get above 100 billion dollars in market cap, it becomes much more of a winner-take-all dynamic as we have seen with Facebook, Apple, and Amazon.

How do you feel about people calling you a “Bitcoin Maximalist?”

Many people describe themselves as Bitcoin maximalists, and there are actually people who describe me as a maximalist too. However, with regards to the first principles, I consider myself an adherent to the principle of freedom. What I mean by that is I don’t think compulsion, coercion, or decree in any form is ever warranted whatsoever. You could also say this respect for Natural Law. According to Natural Law, we all have inborn rights to life, liberty, and property. So, we have the right to be alive, we have the right to be free, and to conduct our actions freely in the world so long as we don’t impinge upon the similar freedoms of others. Property means we each have the right to an exclusive relationship with any form of natural substances that we spend time recreating and adding value to. If we build a hole or we construct tools, we have a right to the fruits of that labor because we have invested our laboring energy into that construction process. That for me is the bedrock of my philosophical worldview and it just so happens that Bitcoin is one of the best tools that’s ever been created for maximizing individual freedom.

How do you feel about the increasing regulations gradually being enforced?

I am not advocating or dogmatically attached to Bitcoin, but as a humble student of the market looking into the history of money, I ask myself “ what does money need to do?” “what is currently being done?” “What are the competing technologies?” I just view Bitcoin as one of the most significant innovations humanity has ever come across. I believe deeply in maximizing the freedom of myself and others which runs counter to our over-legislated world today, where we think more laws could positively sculpt society. However, as Cicero said centuries ago, “the more laws, the less justice.” We only need to preserve Natural Law in our social systems to optimize the outcome for everyone, and I would add that freedom itself is the generator of all wealth. When people can freely exchange with one another, solve problems, have exclusive rights of the fruits of their own labor, and settle disputes in a non-violent way, that creates wealth. This is what incentivizes innovation and civilizational advance in a way that no top-down system possibly can. Innovation cannot be legislated. These things must occur through a natural process of tinkering and discovery.

Is it good to be a little skeptical of governments and authorities?

I consider myself lucky to have a healthy skepticism of authority in general, but I have also read a great variety of books that have sharpened my skeptical mind. I would recommend “The Law” written by Frederic Bastiat. It’s an approximately 60-page book and is a good simple short classic. Bastiat thoroughly decimates the social theories supporting government plunder, and it is very relevant to what we are experiencing in the US today. For example, the US government announced they would print 900 billion dollars and they will send everyone a 600-dollar check for financial aid. Sounds wonderful. Sounds like free money until you do the math: the government printed 900 billion dollars while there are a little over 300 million people in the US which comes out to about 2800 dollars per person. The government is not infusing the productive economy with any new capital, new assets, or innovation by printing money. They are simply reallocating wealth away from those at the bottom who depend on the dollar as a store of value to those who receive the newly printed first. It’s a pyramid scheme. When they are sending each US citizen a 600-dollar check form that 900 million dollars, and they have plundered 2800 dollars via inflation per person, that is a net of 2200 dollars stolen from every US citizen. I call this 600-dollar check a rebate check. This is not plundering only US citizens but also to everyone who is using the US dollar as a store of value well beyond the borders of the US. They are stealing from everyone depending on the US dollar to reallocate wealth to themselves. That is not a viable economic solution for anything, it is just a plundering of the commonweatlth. This just creates many more problems down the road which we are likely to see with the inflationary pressure on the US dollar in the next 10-20 years. This is really bad for humanity: plunder is never justified.

How can we maximize the benefits for everyone?

The best outcomes are always freely selected by people acting in their own self-interest adhering to the Natural Law that refers to basic morality; no violence, no killing, no stealing. If you get adhered to those three pillars of Natural Law, then the creative impulse in people is maximally realized to the benefit of everyone. That’s how we create wealth by trading and specializing, and not by printing to steal from each other or going to war to steal from each other. Or worse still, printing money to steal from citizens to fund wars with rival states, as many governments have done time and time again throughout history.

You can also dive into Austrian economics: a school of thought which thoroughly destroys all these statist philosophies of stealing wealth from some people as a means of solving problems. It is just a flat out lie. By learning and reading these kinds of theories, that shaped my thinking. The great Austrian economist Murray Rothbard wrote: “What has the Government Done to Our Money” and that piece is brilliant. For deeper and greater research of Austrian economics, Rothbard’s “Libertarian Manifesto” is another recommendable book.

Bitcoin and the Tyranny of Time Scarcity

In the article piece Bitcoin and the Tyranny of Time Scarcity, I intended to drill down the first principles of economics to explain why we trade and what the purpose of money is intended to serve in that sphere of human action. The punch-line is, it’s commonly known that people say that “time is money”, and people intuitively know how you spend your time has different outcomes. You can spend it sacrificing on the behalf of others and earn money which you can then redeem that money for commensurate sacrifices from others. That’s sort of common knowledge, but the reciprocal of that equally true yet less well understood: “money is time.”

In a free-market economy, people engage in activities that are meaningful to them, and they have specialized skills. They can adequately channel their time towards activities that benefit society and trade it with others. You can store your savings in the form of gold or Bitcoin that would be free-market produced money which is a way of storing time that is not easily stolen. Whereas when you look at monopolized money like a fiat currency, when they are printing money, they are actually stealing time from all of the citizens forced to use the US dollar. When the government prints 900 billion dollars, which should be equivalent to 2800 dollars per person, but sends the people a 600-dollar check, we have stolen 2200-dollars’ worth of time from every individual in the US. You can take 2200 dollars and divide it by the average hourly wage in the US, and you will get a proxy for the actual hours stolen. Today, the average hourly wage is around 12 dollars in the US, and when you do the math you will find that on average 183 hours have been stolen from each citizen in the US through this single act of fiat currency debasement alone.

The purpose of trade is to overcome the restraints of time scarcity by becoming more productive, to “to do more with less.” In this effort to overcome the natural tyrant of time scarcity, we need institutions to coordinate human action at scale, and in this process we have accidentally given rise to this artificial tyrant called the central bank that steals time from the productive economy on behalf of its shareholders. Although intended to support the productive economy, central banking is now a menace to humanity. The central bank is an institution of systemized time theft, one of the largest criminal enterprises in history.

Interviewer , Editor : Lina Kamada

【Disclaimer】

The Article published on this our Homepage are only for the purpose of providing information. This is not intended as a solicitation for cryptocurrency trading. Also, this article is the author’s personal opinions, and this does not represent opinion for the Company BTCBOX co.,Ltd.