Rafael Schultze-Kraft is the co-founder and the CTO of Glassnode. He was born in Colombia but is based in Berlin now. He has an academic background in cognitive science and computational neuroscience. He got into programming, data science, machine learning, AI, and other different topics through his studies, which led him into the realm of data science. He became a data scientist, and had been working as a data scientist in the Berlin startup world for 7 years, before co-founding Glassnode.

Interview Date : 15th January 2021

How did you become the co-founder of Glassnode?

Roughly 2,5 years ago, I met my current partners and co-founders of Glassnode who are from Switzerland and had been in the crypto industry as investors for many years. They had a need to get hands on better data in order to make better investment decisions. So, Glassnode was essentially born out of our own needs. I immediately fell in love with the idea because, as a data scientist, this was like bringing together my two favorite things in technology: data science and Bitcoin. So I was happy to join as co-founder and CTO focusing on on-chain data.

What is On-Chain Data?

I think that on-chain data is something completely new. it’s a new kind of exotic data that does not exist in traditional markets. Now we have open ledgers (blockchains) that have millions of recorded transactions. And there’s a lot of information and a lot of value in that data with respect to fundamentales and the market. From on-chain data, we can know how to time the cycles of these markets. I think this is something anyone involved in this industry would want to have an eye on. You will get a grip of what is going on under the hood, how network participants and investors are behaving.

Is On-Chain Data easily accessible?

Even though on-chain data is publicly available, it is not something that is easily accessible. Anyone can go to a public ledger and read the data, but it’s very inaccessible in its raw form. I think that is the value that Glassnode actually provides; we do the bulk work of extracting the raw data and contextualizing it in easily-to-digest metrics. Thus, people get a very easy and direct gateway to already processed and contextualized data across different digital assets, which they can use to understand the network. Users can use it to assess adoption, network activity, investor behavior, to time the market, and gauge the sentiment.

What does the Address indication Metrics say about the market?

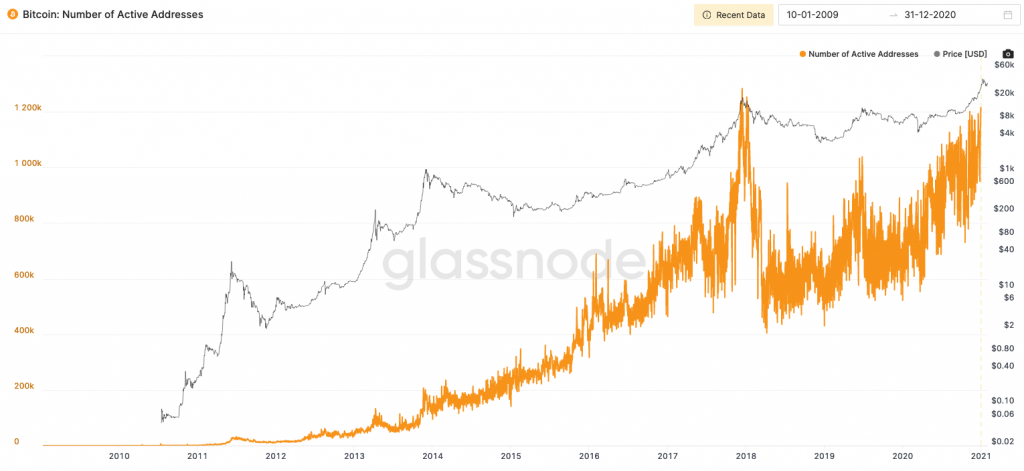

Active addresses is a nice example of a fundamental and popular metric. From this metric, we can see how many addresses on the blockchain have been active over a certain time that have been sending or receiving BTC. So, that tells you a lot about network activity. Certainly, one active address does not mean that there is one user. As we all know, you can have one user that owns many addresses or you can have one exchange that works as the custodian of Bitcoins from many different users. But you can view this as a proxy to how many new participants are actively interacting in the network, and how that is trending. It gives you a sense of the health of the growth, and the adoption of the network. For instance, there is a clear relationship between the on-chain data and the price indicating a relation between the price and the user activity.

Is it healthy for large entities to enter the crypto market?

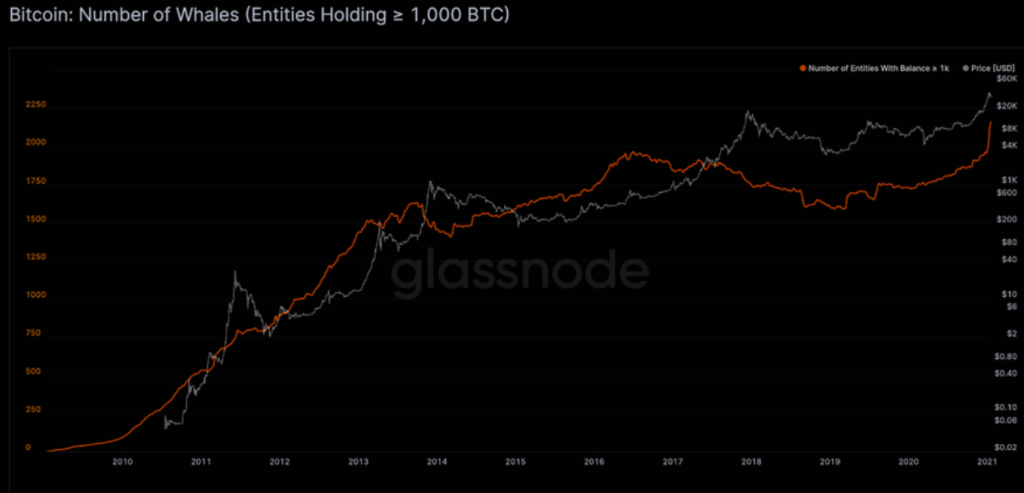

Industries coming into space is, in general, a very good sign, and it will have a very positive impact on industry development. This shows that this market and this new asset class has matured a lot. One of the biggest differences that we are seeing in comparison to the 2017 bull run, which was very much retail-driven, is that the current bull market is mainly driven by high-net-worth individuals, institutions, family offices, etc. And, this is positive because it shows there is infrastructure in place. This infrastructure allows these high-net-worth individuals to make whale purchases and hold their coins with custodian services. For all the other individuals that have been in the space before, this is highly appreciated. The supply is simply being absorbed, and it shows that there is a demand for smart, mature, and big money. As more and more corporations have entered, the price has risen, and I think that individuals and retail investors can be happy about this development and the adoption of the space.

Are High-Net Worth individuals here to create speculation?

I don’t think that corporations or high-net-worth individuals are here for speculative moves. Even high net-worth individuals have now understood the value of Bitcoin as a hedge against fiat and inflation. They have understood that this is an asset that is not going to go anywhere anytime soon. That’s what shows the maturity of Bitcoin. I strongly believe that these big players are here for the long run.

How many Bitcoins are entities holding?

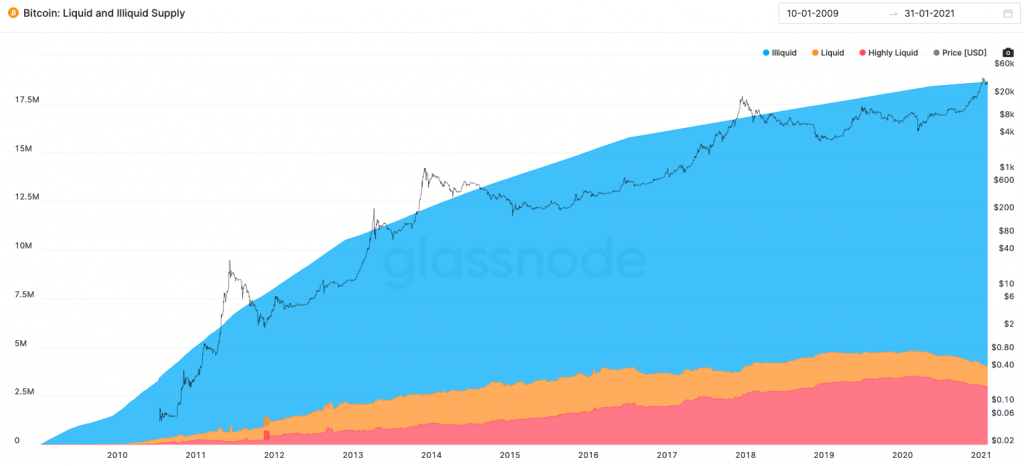

There is 21 million Bitcoin in total. 18.6 million have already been mined and one would want to know who is holding how much, how much is actively being traded, how much is on exchanges, how much is still with miners, etc. The liquidity is found when we look at all the entities on a network-level and define a threshold by which we classify them into liquid and non-liquid depending on how much Bitcoin they are spending.

That is how we got the beautiful insight that 78% of all the supply is being held by entities that are classified as non-liquid. That means BTCs are very hard to get your hands on as they are not for sale in large amounts at this point in time. This leaves you with a smaller percentage of the circulating supply that is actually available in the market constantly changing hands. I think this adds to the scarcity and the accessibility of Bitcoin and leads them to things like reduced sell-pressure and higher demand. Because there is not enough supply, there is less liquidity on exchanges, etc., and you can understand these kinds of market dynamics through on-chain data.

How did you go from neuroscience to Bitcoin?

I started off studying computational neuroscience and cognitive science because I was interested in the big questions of life, like “Who are we” or “How does the brain work?” and “What is consciousness?”. Through computational neuroscience, I actually started to delve into the realm of data modeling. This was about creating mathematical models of neural and cognitive processes to understand the inner workings of the brain better. This is where I learned to program, as well as machine learning and intelligent data analysis. This is how my path down to data science started.. From there, I combined my passion for data with my interest in Bitcoin. This wasn’t too difficult to put together because if you apply machine learning methods and data science, the methodologies applied are the same. They are independent on whether you apply them to electrical signals in the brain, to customer data, or to on-chaine data. So, the methodology is universal and can be applied to both neuroscientific and blockchain data.

Interviewer , Editor : Lina Kamada

【Disclaimer】

The Article published on this our Homepage are only for the purpose of providing information. This is not intended as a solicitation for cryptocurrency trading. Also, this article is the author’s personal opinions, and this does not represent opinion for the Company BTCBOX co.,Ltd.