Alessio Rastani has worked as an independent trader and in the research of the financial markets for over 10 years. He has become a widely followed commentator, releasing countless videos, reports, and online educational material on subjects such as trading and the technical analysis of stock markets, crypto, forex, etc. He started his career as a trader after the crash of the famous dot-com technology in 2000. Chart Analysis for both the stock market and the crypto market is one of his specialties and favorite topics. He Has been invited to many seminars and events, including to the TEDtalk stage, to speak in London, USA, the Netherlands, and Hong Kong.

Alessio Rastani

Interview Date : 29th June 2020

From Law to Trading

My academic background is actually in Law, so it has nothing to do with finance. It was a bit of an accident that I went from law to trading in stock markets and chart analysis. The investor-friend of mine from Goldman Sachs really inspired me to learn about the markets and trading. Now that I look back, I am actually glad that I left my original profession, Law. Even though I enjoyed the legal profession, I don’t think it would have been the right one for me to stay in for the long term.

Potential Is There for Altcoins Too

Not only in Bitcoin, but I am also a huge believer in Altcoins. I cannot say that I am an Altcoin expert, and there are people out there that know much more about it than I do. However, I have looked at the markets, like Ethereum, and I also like XRP and NEO. I know some people hate those Altcoins, but I am not a Bitcoin maximalist. I think that there are plenty of opportunities within Altcoins as well, and it is good to keep an open mind. I was looking at some

Being a Contrarian pays off

I started youtube by coincidence. I originally started a travel vlog, and it was supposed to be only for some of my travel videos until I realized I wasn’t that good at it. So, I decided I wanted to go and do other kinds of videos, and since, I started posting videos about chart analysis. I made a video predicting that Bitcoin was going to collapse, and at that time, Bitcoin was around 10000 dollars. I never imagined Bitcoin going from 10K to 20K in a week or two. So, it was a surprise to me, but that rate did not last either. However, When I posted the video before the collapse, a lot of people were angry at me for saying that the Bitcoin bubble would burst. Eventually, it did burst. I noticed that often when you do a contrarian video on youtube when you say the opposite of everyone expects, you will get a lot of blow-back. People will say things like “you are crazy” or “you are wrong”, and it is going to cause a lot of anger in some people, and I understand that. But, I think it pays to be a contrarian. Usually, when the majority of people say “Alessio, you are wrong”, and they get aggressive, I like that because it shows that there is a fear of what I have predicted actually could be right.

Markets can Humiliate You

It is very hard to be an independent trader and to do market analysis because the markets can change within a day or a week, and the prove you wrong and humiliate very quickly. Something you said a week ago could prove you wrong by the next day or week. This is by far one of the most difficult professions to be in. If you want to be a chart analyst or a trader, you need to be open to possibilities, and you should never get too comfortable in any position. Thus, being open to change your strategies、 and to change your mind quickly is important. The people who are not good at this job are the ones who are reluctant to change or admit that they were wrong about something. You see those Gurus on TV, who unfortunately are so full of their ego that they don’t realize the market can prove them wrong very quickly. So, you need to be humble in this profession, and if you do a forecast that turns sour, you shouldn’t take it personally and just move on.

Uncertain Monetary System

I don’t know how the monetary system will evolve from this point. I think that economists who have predicted a monetary crash in the near future are right, and it is going to happen in the next few years. The crash in March this year was the biggest one everyone was expecting. However, what happened in march brought us to a market bottom and we could go much higher in the stock market and Bitcoin as well, but that was not the economy crash of the monetary system that we are talking about. I do think that a bigger crash is waiting ahead of us.

Decentralized system more than Centralized

The people who truly believe in crypto think this is a generational change that will be with us in the future, and I agree with them. There is a fundamental case to be made, don’t just be involved in fiat currency, but be involved in edgier bets like gold, silver, and cryptocurrencies. When I hear people say Bitcoin will go to 0, I am skeptical about that. I don’t think that is going to happen. Is it possible that it may happen? Yes, it is, but it is very likely. Eventually, governments will find a way to live with Bitcoin rather than getting rid of it.

However, even though we know that cryptocurrencies and digital currencies are the future, we don’t know which currency will out-survive everything else. Maybe it will be Bitcoin, but if not, it will at least be a digital currency. In the same way that the internet and dot-com changed the world 20 years ago, the same phenomenon is happening with Bitcoin. It is a generational civilization change that is happening, so I am a bull on Bitcoin in the future.

Books on How to Trade and Invest

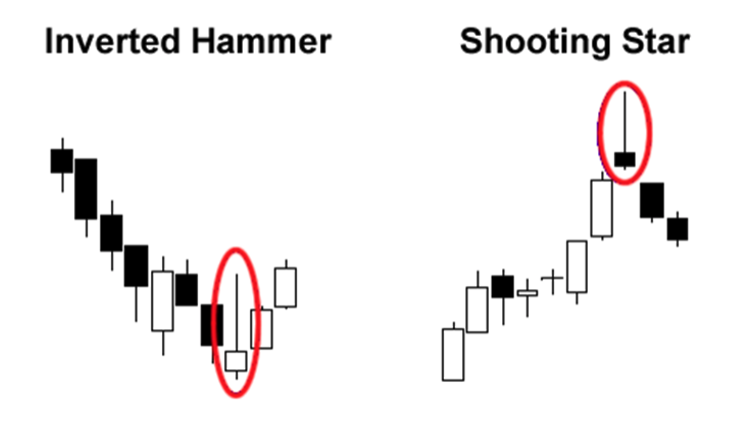

One of the books that I would recommend for learning how to read charts and for trading is Japanese Candlestick charting Techniques by Steve Nison. You do not need to know every single Japanese candlestick pattern method. The ones that I use the most are Hammer, Shooting Star, Bullish engulfing patterns, and the bearish engulfing patterns. So that is a great book to start with.

One of my favorite traders is Linda Raschke, and she has published a book named Trading Sardines. I also like Trading in the Zone by Mark Douglas is a great book for those who want to understand the psychology of trading. I stand by that book, it’s fantastic.

One Idea is Enough

I don’t use every single tip or advice from all the books I read. Sometime when you read a book, there will be one particular idea that will stick with you that will be useful. For example, I don’t use any single pattern from the Japanese chart analysis book. I don’t think that it’s necessary, or even useful, as reading one too many formula analyses can cause analysis paralysis. You may come to a point where you over-analyze something to its bottom with no meaning left behind it anymore.

When I first began to learn Chart analysis and trading, my friend who worked for Goldman Sachs, taught me some of his favorite strategies. His favorite strategy was the Shooting Star and the Hammer Candlestick Pattern. We would plot on the chart. He would say “ you wait for an up-trend in the price in a market, then you look for the price to pull-back to support like a 21-day moving average, and wait for hammer candlestick patterns. When the hammer candlestick patterns would form, and so a break about that hammer candlestick pattern would be a buy, and the opposite applies to shoot star pattern. So that is one strategy that has been very useful to me for a long time.

Chart analysis Learning

There are a couple of good books out there on Bitcoin, one is Dominic Frisby but it is a couple of years old now. However, if you want to be in the Bitcoin and crypto sphere, you really should just immerse yourself in the industry. You can do so by doing chart analysis and looking at price actions, and practice over and over again. You have to continue to learn about the markets and trading because you never stop learning. Moreover, the markets are changing now and then. Even the patterns change, so you want to learn those new patterns and how the markets are evolving.

Interviewer , Editor : Lina Kamada

【Disclaimer】

The Article published on this our Homepage are only for the purpose of providing information. This is not intended as a solicitation for cryptocurrency trading. Also, this article is the author’s personal opinions, and this does not represent opinion for the Company BtcBox Co.,Ltd.

Please pay attention to the following points when trading cryptocurrency.

(1) Cryptocurrency is not the legal currency that is supported by the government such as yen and US dollar. It is an electronic data on the Internet.

(2) The price of cryptocurrency may fluctuate drastically. There may be a sudden drop or loss of value, and you may suffer losses.

(3) The cryptocurrency exchange needs to register with the Financial Services Agency and the Finance Bureau. We are a chartered cryptocurrency exchange (Charter Number: East Japan Local Finance Bureau No. 00008).

(4) When trading with cryptocurrency, please read the explanatory documents (The terms of use, etc.) on our website and decide for yourself whether or not to conduct a transaction.