Lyn Alden is the founder of Lyn Alden Investment Strategy, where she provides market research to tens of thousands of individual investors and financial professionals. With a focus on income-generating investments, she provides the overall macro picture of the industry. Lyn reminds us why it is important to look at the bigger picture, especially in crypto. With her weekly newsletters and informative research, she has become a known name in the Industry. Please take a look.

Interview Date : 13th October 2020

- Lyn Alden (All Interviews)

- When Did You Discover Cryptocurrencies For The First Time?

- When Did you Enter The Rally?

- What To Know Before Joining

- Taking A Third Person Standpoint

- Bitcoin Is Viewed As Digital Gold

- What Is Happening To My Money in The Banks

- Negative Real Yield Age

- Boom Bust Cycles

- 1930s Illegal to Hold Gold

- Reducing Tail Risk

- Diversification Can Stop Major Wealth Loss

- Countries With No Stock Markets Still Have Impact

- Attention Needed to Be Paid To What?

- Deflation

- America’s 401K

- Investor vs. Trader

- Tokens with Custodians

- Secondary Layers Keeping Fees Low

- Why Even Join the Space? Take a non-Zero Position

- An Annual Report to Keep Oversight

Lyn Alden (All Interviews)

My name is Lyn Alden. I run the Lyn Alden Investment Strategy site. My background is not specifically for Bitcoin, but I specialize in a broad spectrum of different asset classes including equities, bonds, precious metals, and other alternatives as it in this case includes Bitcoin. My approach to these different asset classes is to research and find out where value and growth potential lies. That is how I started delivering a lot of Bitcoin writing to my audience. I started being active in the crypto space a little bit in 2017, but I became quite bullish on it in April 2020. Since I have been a little bit more forthright about how bullish I am about Bitcoin.

I provide research for both retail investors and institutional investors. I provide my audience with articles and a free newsletter. I also have a low-cost premium usually coming out every 2 weeks. I combine macro analysis with a Company’s specific analysis and look at different factors. For example, what is going on with unemployment, liquidity, fiscal stimulus, etc., are some of the major drivers for different asset classes. I dive into individual companies, taking that macro background and combining it with individual investments.

When Did You Discover Cryptocurrencies For The First Time?

I became aware of Bitcoin back in 2011. I had a friend that mined on her computer. I thought it was a much-needed technology and a great idea at that time, but I never got fully knowledgeable about it. It was kind of viewed as a novelty, and I just thought it was a neat technology. I buy any at the time, unfortunately, but every year thereafter, I would check on the space a couple of times. It was not until 2017 when the big bull market was rising exponentially, and when it got a lot of media attention, that I started to cover it. I received a lot of emails from my audience asking me to cover it, and then at the time when I was writing my first article about it, the price of bitcoin went from 6000 dollars to 8000 dollars. I analyze it in a couple different ways; one way was to look at it as a medium of exchange, and the other way was to research it as a medium for store of value. I determined that it was probably overvalued as a medium of exchange, but pretty interesting as a store of value.

When Did you Enter The Rally?

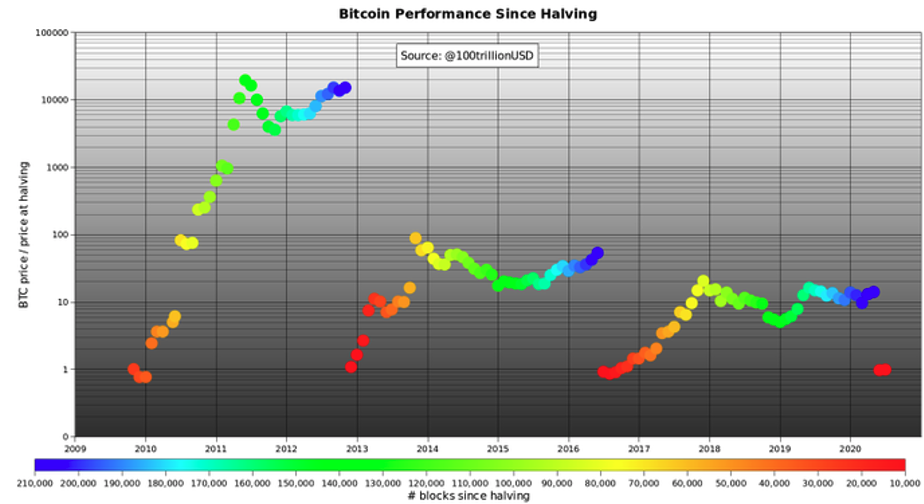

Due to how overbought it was at the time, and how much enthusiasm there was, I took no position and I leaned bearish on it in the near term in 2017. Then, it went all up to 20 000 dollars and crashed down to under 4000 dollars. Moreover, when it had the drawdown with most other asset classes in March of 2020, it round-tripped all the way down to under 5000 dollars again. However, it was back to the 6-7000 dollars range roughly one month later, and that’s when I started to analyze it. Things changed after that; the macro factor was much better, we have low-interest rates, big fiat money creation, etc. Bitcoin was coming up to a halving event in May 2020, and I did a bit more research on Bitcoin halving cycles to see what the price schemes of Bitcoin looked like. Now we know that there is a bullish trend 2 years after the launch of halving cycles, whereas 2 years before halving cycles, Bitcoin tends to be consolidation periods.

So, there is a period where Bitcoin is going to do well and a period it is not. I became more bullish this time than ever, and that is why I recommended it and I went along myself.

What To Know Before Joining

I have a degree in engineering, so I generally come at things from a technical perspective. I have done some coding, but I am not really much of a coder, so I have never really looked at Bitcoins software, for example. For me, the technical part, such as the key things that the non-technical people have to understand, is the core ideas of how it works; how the encryption works, how blockchain works, how the peer-to-peer system works, why it is limited to 21 million coins, what would be required to change any of its major features like the consensus mechanism which it uses, etc. Non-technical people still need to understand enough of the technical aspect to understand the asset class.

Taking A Third Person Standpoint

Part of my work in 2017 was trying to figure out more about those hard forks. We experienced a couple of hard times in the industry, and I was concerned that Bitcoin was losing market share among other cryptocurrencies due to that. Multiple other cryptocurrencies were outpacing it, so the Bitcoin market share fell into the 40% range of market share. Even though any cryptocurrency coin is scarce and there can only exist a certain number of units based on the way their consensus protocol, anyone can create a new cryptocurrency. I was worried thinking “what if they all dilute each other?” or “What if there are no 1 or 2 coins that gain most market share, network effects or do not have their individual coins growing in value?” Especially during hard forks, there were debates about which direction it would go in terms of block size, and all the pros and cons. I just watched the space, and eventually saw the settlement established. Up to that time, I kept researching technically why a certain block size is better than another from an outside perspective. I was convinced that Bitcoin had enough of a network effect to hold value even if thousands of cryptocurrencies would be created. Bitcoin survived the hard forks and thousands of new challenges. It has security, the hash rate, simplicity, and decentralization which are all major aspects we want. Therefore, learning enough about the technical aspects to make sure I know what I am getting myself into is how non-technical people have to approach it.

Bitcoin Is Viewed As Digital Gold

As the saying goes software is eating the world, software comes from one industry and it goes to another industry, and it keeps attacking whatever the status quo is. Similarly, Bitcoin is a software attacking money that digitizes gold in a way. We can say it is a scarce digital store of value that has some advantages over gold, including being more portable, harder to confiscate, easier to verify, and has lower transaction costs. I think the way to understand some of the main macro factors about Bitcoin, is to compare it to the alternative which is fiat currency. If someone can hold money in the bank keeping all their value in it, and even grow their value from positive interest rates, it would make a low incentive to take that money and instead put it in gold or Bitcoin.

What Is Happening To My Money in The Banks

Historically, there has been currency devaluation where governments have printed a massive amount of money, or they have a prolonged period of interest rates being below the inflation rate. So, they slowly chip away your wealth over time. In those periods, those scarcer assets tend to do very well. Thus, whether it is gold, silver, equities. real estate or in this case Bitcoin, I think going back to the history of fiat devaluation and why they tend to happen, why they don’t happen in some periods but do in other time frames is important.

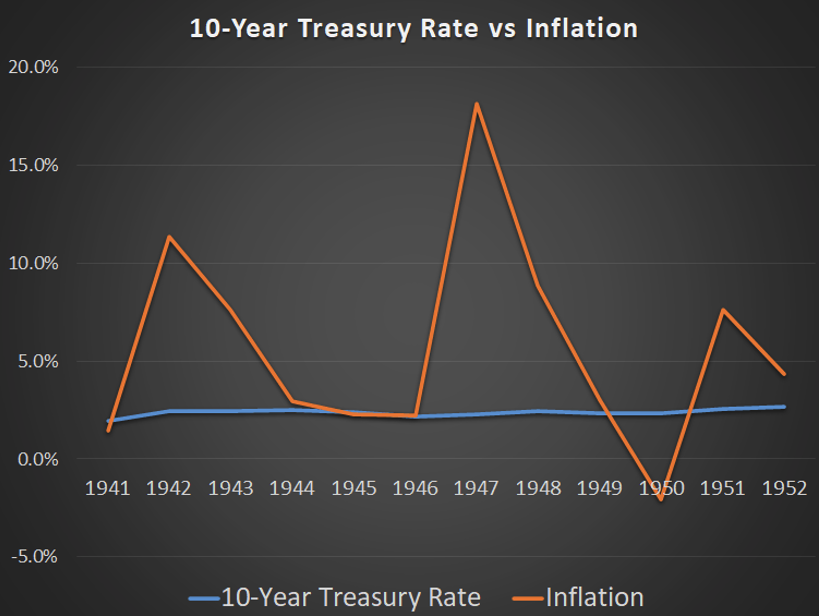

It is insightful to know why we have had big devaluation all in one decade alone, for example. Understanding the difference between real interest rates and nominal interest rates; not just looking at interest rates, but also at “interest rate” – “inflation rate” to see what is truly happening to my money in the bank. Knowing what is happening to my sovereign bonds, and looking at those alternatives to understand why the case for gold and Bitcoin makes sense in this environment.

Negative Real Yield Age

In most countries around the world, we are in a period of negative real yield. Meaning that most of our bank accounts and most of our bonds pay below the inflation rate. This is likely to persist for quite some time due to how much debt there is in the system.

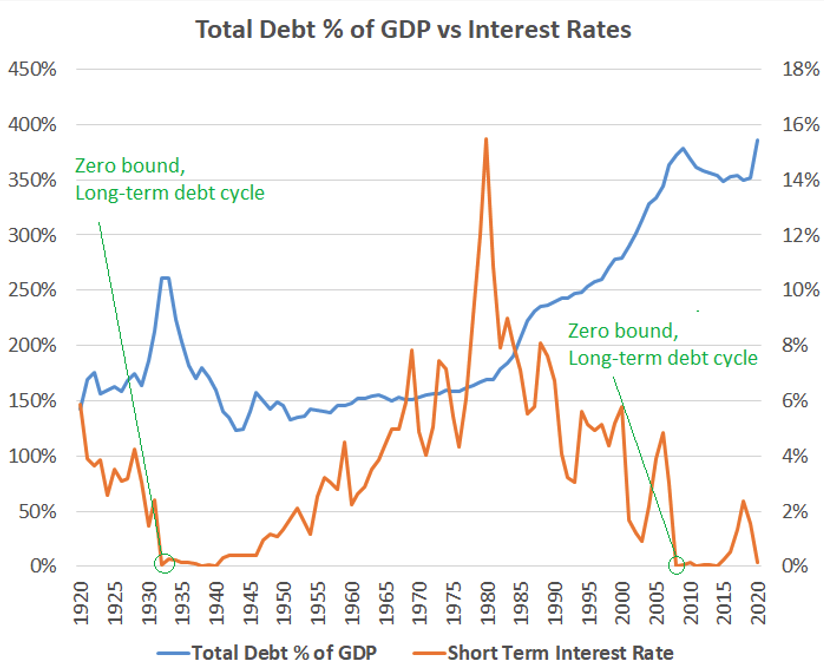

Some of the macro research I do is inspired by Greg D’Aleo who popularized the topic of the consequence of a long-term debt cycle. We did have a big debt problem before the pandemic, and the pandemic made it worse. If you look at the short-term business cycles in many countries, you have this “boom-bust cycle” where you have debt build-up in the system. There will be some sort of a catalyst that either hits the economy naturally, or governments get an external catalyst that creates negative feedback for the economy. With that, we get a period of deleveraging and recession. So, central banks come in and cut interest rates, whereas fiscal authorities step in and spend money to stimulate the economy. The authorities will partially deleverage, so companies and households with malinvestments get defaulted on. Because interest rates were lowered, they never really deleverage all the way. Maybe the interest rate will be deleveraging only half the way, and then governments start building up from there. The driving force behind this is especially due to policymakers wanting to make it quick to keep recession short and get people back to work. Thus, they partially deleverage and start building up from there.

Boom Bust Cycles

If we string multiple of those business cycles together, you get long term debt cycles, where interest rates get lower and lower, and debts get higher and higher as a percentage of GDP. That all comes to a head when interest rates hit 0, because the central bankers will not be able to stimulate in that way anymore. There are very big “boom-bust cycle” characteristics particularly here in the US. When they hit the 0 bound and they cannot do much more, that is when fiscal authorities come in and they spend a lot of money.

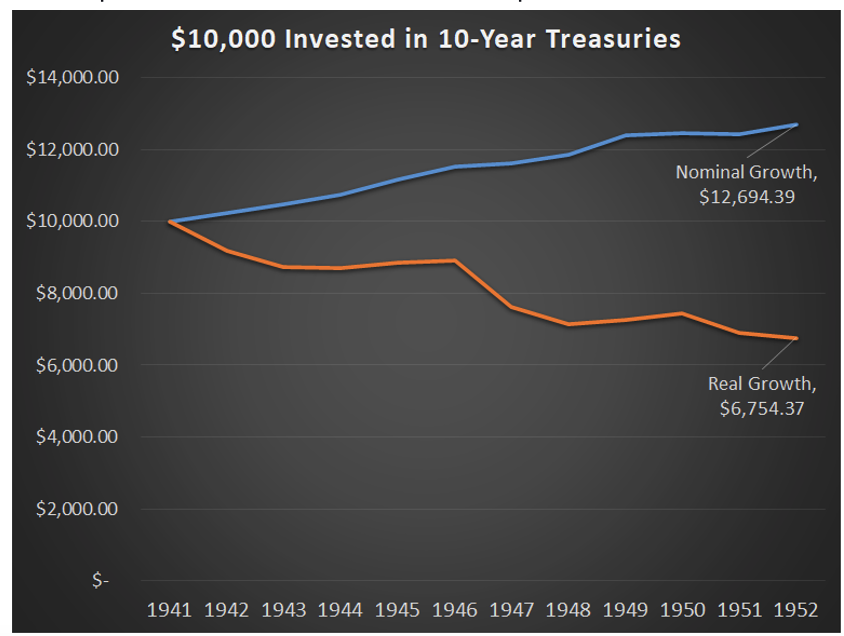

If you look back at US history, the last time interest rates hit 0 was in the 1930s. Eventually, that was resolved by massive fiscal spending with yields for bank accounts and bonds being kept below the inflation rate. The authorities basically inflated a lot of that debt away. All of the sovereign debt was paid back nominally, but people lost in terms of purchasing power. Anyone holding cash or holding sovereign bonds got all their money back, but the same dollar now bought a lot less. This is how historically monetary sovereign countries get out of big debt bubbles. From the mid-1930s to the mid-1970s, there was roughly a 40-year period where 10-year treasury bonds, for example, were very poor investments. It was worse in many other countries that lost wars in that period.

The US was actually one of the stronger countries for having the least currency devaluation. Thus, these things tend to happen on a global scale, it is not only one country it can affect. Even though it was a relative situation, the US treasuries lost ⅓ of their purchasing power in the 1940s, and another ⅓ of their purchasing power in the 1970s, when you add both those two factors together are really how federal debt as a percentage of GDP was decreased. We saw similar and usually worse playouts in other countries.

I believe that sovereign entities have 2 potential options. For the first, they could try to do some debt jubilee with their sovereign debt the central bank forgives the sovereign debt. They can use financial engineering to have that happen. Or, they can hold interest rates below the inflation rate for a while. But by doing that, anyone holding these bonds or cash in the banks has their purchasing power chipped away over time.

1930s Illegal to Hold Gold

Back when people didn’t have computers or the internet, information got around a lot slower. People could not go online, and see what the inflation rate was, or what their rates were. There was far less information available, and even the people who were watching out for the markets were just getting all the information from newspapers. However, the majority of many people were not following it at all. In the 1930s and 1940s, one of the answers to maintaining your wealth would be gold. In this way, if you held gold, you defended against all that currency devaluation. To cancel out this option, many countries including the US, made it illegal to own gold. Also, because people could not track real-time information, they did not really see the need for it to buy gold.

We know what the authorities did back then, so have understood the playbook. Today, we can see every move in real-time, and we can directly measure rates, etc. I think this knowledge does create more incentive for people to find alternative assets. That is what we are seeing in equity markets today, where we have the worst ever economic shock for many countries since the great depression, the worst economic situation in decades, but we have stock markets that are doing pretty well. That is because people are realizing “I rather own stocks than keep my money in the banks, with the amount of stimulus that’s happening”, and they think “I rather own a kind of equity in a company that produces cash flows.” Accordingly, we have seen very good rises in Gold as well as in Bitcoin prices in the past 2 years and Bitcoin.

Reducing Tail Risk

I think diversification helps reduce tail risk. If you put all your assets in one sort of asset class, it’s easier to have a 30~40 % drawback in that asset class whereas if you diversify, it can be protected to some extent. Now there will be occasional periods, where there will be a liquidity event like we saw in March. Although all the assets dropped together, they pop back up at different rates depending on how much they were impacted. Certainly, Gold and Bitcoin popped up very quickly because they are non-debt instruments. On the other hand, bank stocks and energy stocks came back less strong because they were more impaired. If people can ignore some of the short-term volatility, diversification can play a strong role in protecting major loss of wealth.

Diversification Can Stop Major Wealth Loss

Equities, real estates, even from foreign countries should be considered. I have US, European, and Japanese equities plus emerging market equities. I have that it spread out so I am not tied to any one market or to one set of fiscal policymakers. In our present environment, I think Gold and Bitcoin add a lot to a portfolio. Historically, Gold tends to be inversely correlated to real industries. When you put your money in a bank and the interest rate you get is higher than the inflation, for example, a 2 % interest rate a year, would be a pretty good environment to hold cash. In such cases, Gold tends to do less, but if you would get a 0.5% interest rate in a bank where inflation is 1%, you will be slowly losing money by holding it in a bank. You always have that potential tail risk of a more rapid loss of a currency, therefore, some of those alternatives like Gold, Bitcoin, appropriately priced real estate, commodities, or anything that has scarcity in such environments tend to hold up pretty well. Thus, I think diversification reduces that fear to some extent.

Countries With No Stock Markets Still Have Impact

Countries that do not have any stock markets have strong incentives to get into some alternatives like Bitcoin. Currency weakening is a strong factor leading people to Bitcoin, and fortunately, Bitcoin is one of the most accessible assets for people now. That is also one of the advantages it has over Gold; everyone with an internet connection can find a way to get Bitcoin. It is a way for people to take their purchasing power out of their local currency. Iran is another example where they have been promoting mining. It is interesting when you see the different policy responses from country to country. For example, Russia and China have been a little more antagonistic towards Bitcoin whereas countries like Iran and Turkey have been more open to it. So, they all are responding to it differently, but generally, the people from such countries have more experience with currency devaluation. They understand the value proposition of hard assets far better than people that live in developed countries.

Attention Needed to Be Paid To What?

Pay attention to real industries around the world, because that is one of the major drivers and incentives for people to try out alternative assets. When you are in a prolonged negative period, there is more incentive for people to buy Gold or Bitcoin, or some farmland, basically anything that is scarce. Some of those assets do not yield anything which normally is a high opportunity cost. If you can get a positive return on your investment, like for holding it in a bank or in a sovereign bond, then you should have it in the banks. However, when you cannot get any positive yield from those saving instruments, some of those high-quality yield-less assets become a lot more attractive. In some cases, you can even get a yield on those assets, like India has gold bonds. Other companies offer yield on Bitcoin. Thus, there is a higher incentive to invest in scarcer assets when you have negative real interest rates.

Deflation

Ideally, deflation is better for an economy, because your money will get stronger. I have had a couple of podcasts with Jeff Booth, and one of his arguments was that technology in itself is very deflationary in a good way. In a sense, it enhances our productivity, and it makes things a lot cheaper. So, our money should be able to buy more. However, because the economy is so debt heavy today, meaning that we have so much debt relative to GDP, income, and the money supply, we are not set up in such a way where prolonged deflation can be allowed to occur. That would result in a systematic dead-collapse. Ideally, authorities should shift to a system where they would resist the temptation of authorities interfering in the market and creating short business cycles. In the shorter business cycles, every single time the central bank comes in and lowers the interest rates to make a recession as short as possible. They will continue to do that until it goes all the way to 0. Letting business cycles play out more, at least from a monetary standpoint, they can still do some fiscal support, but still not encourage debt to go too high. Subsequently, deflation can strengthen people’s currency. For now, they need to figure out how to get this debt bubble, which is likely to become inflationary at a point. From thereon, they have a choice to go with the more inflationary system that can be pretty beneficial, and I hope they do so.

America’s 401K

401K is a type of account that you can use to hold investments. Decades ago, companies used to offer pensions, but that changed. Over time, they started shifting to 401K. This account is a system account offered by an employer for an employee. An employee can put a percentage of their income into 401K from their paycheck, and it will not be taxed. Usually, the employer matches that; if the employee puts 5 % of his or her paycheck in, the employer will also put 5% up to a certain time. Now, that money will be put in a vehicle where it will be tax-advantaged, and you can invest in equities, bonds, ETFs, etc., depending on what kind of asset class is being offered. When people start withdrawing from it or retire, that is when they have to start paying tax on it. You can think of it as an investment for people, and this is one of the reasons why people in the States are heavily investing in equity markets. Besides 401K, Roth IRA is another version of this. We have all these different kinds of accounts that encourage equity ownership, and they tend to be equity heavy. Compared to Europe or Japan, Americans tend to have a lot more of their net worth in equities than other places.

Investor vs. Trader

I am an investor in the sense that I have a multiyear holding period. I do not trade on the edges. Traders tend to be more interested in alternative coins because they can have more volatility. They can triple their money but they can also lose half of their money overnight. For an investor, it is mainly about timeframes considering things like “will Bitcoins market cap grow over the next 3 to 5 years?” or “what are the drivers that increase in value in Bitcoin”, and “what are the risks”. On the contrary. If you are more into trading and looking at technical charts, you are more looking out for what’s going to happen today, next week, and next month. So, it is just about different time frames and different goals.

Tokens with Custodians

Gold tokens are a good application of technology, and it is a way for people who want Gold to get more liquidity. Compared to ETFs, you rely a little bit less on centralization. However, the problem with Gold, unlike Bitcoin which is purely decentralized and no central custodian is holding it, is the value that we all trade around. Something like a gold-backed cryptocurrency or a gold ETF is an asset all kinds of people trade with. These tokens are still held by a central custodian, so you still have to trust them when they say “we have all the reserves”, “we can verify” or “governments will not interfere or confiscate”. I think once it is invented the technology can be applied to multiple areas, but it still is somewhat different than Bitcoin itself.

Secondary Layers Keeping Fees Low

Space is still in its infancy. It has become more efficient than before, but the fees are getting higher. I think some of the secondary layers, like the lightning network, so are getting responsible for keeping fees low. You can for example wire money from one bank to another, but that is a very time-consuming and expensive process. You would not want to do that for every transaction, especially not small transactions. For smaller transactions, we have a couple that is a global platform to more quickly send money like Paypal, but every country has its own platform as well. Sending money over Bitcoin is still pretty efficient right now. It takes a while for it to settle but the fees are still pretty reasonable. I think as Bitcoin scales over time, we are likely to see more importance fall on the lightning network and other secondary layers. They take some of those transactions off the chain, process efficiently, and then settle on the chain again.

Why Even Join the Space? Take a non-Zero Position

One of my approaches to decide whether or not to join the space is making the argument for having a non 0 position. It is not necessarily an argument for having a very big bet on Bitcoin, rather it is an argument for “why 1 % is better than 0%” or “2% is better than 0%”. If someone that has 1%~2% of their portfolio in Bitcoin, that asymmetric kind of risk-reward can add a lot to a portfolio compared to going all-in or putting 20% of your portfolio in it. Certainly, some people study the space, know it very well, and have high conviction, so they can put a lot more in. However, it is worth noting that the Bitcoin market capitalization is currently a fraction of 1% of global wealth. If people have 1% of their wealth in Bitcoin, they are already ahead of the curve. They will have created a position in the space for themselves. Another reason is Bitcoin’s price. If you look at a chart in log form, which makes it less exponential, you can see that the price tends to have these peaks and these multiyear consolidations. In other words, Bitcoin tends to time pretty well with halving cycles. The trend goes like this:

Consolidation > More Consolidation> Little Bull Market > Full Bull Market> Correction and Consolidation, and this continues until the next halving cycle. We have been in this 2~3-year bear market where Bitcoin has not reached a new height. So, it is natural for the space to weaken a little bit or not experience an increase in user volume. However, it is very informative to look at a log chart, even though it is the price that ignites interest in people. If Bitcoin ever breaks the 20 000 dollars, that will get people a lot more interested again, because they will feel like the bull market is back.

An Annual Report to Keep Oversight

I publish an annual report every year that tracks about 30 countries. That puts all the information in one space, and I also focus on a handful of them more closely. I have one big block where I put the US, Europe, Japan, China, India, Russia, and South America as a whole. Those are the key baskets I follow to some extent just to see what the opportunities are. If you are looking at S&P 500 companies, it is hard to get a pricing advantage from one or the other because there are just so many analysts that are looking at every company.

Interviewer , Editor : Lina Kamada

【Disclaimer】

The Article published on this our Homepage are only for the purpose of providing information. This is not intended as a solicitation for cryptocurrency trading. Also, this article is the author’s personal opinions, and this does not represent opinion for the Company BTCBOX co.,Ltd.