David Andolfatto serves as a Senior Vice President in the Research Division at the Federal Reserve Bank of St. Louis. He is Canadian-born to Italian immigrants and worked in the construction sector before going to school to become an economist. He worked in the Canadian university system for 20 years before joining the Federal Reserve. He joined the Fed in 2009 and advises St. Louis Fed President James Bullard on monetary policy. Mr. Andolfatto also coordinates FOMC briefings and participates in Research Division matters with colleagues.

Interview Date : 2nd February 2021

What do you think of major corporations investing in Bitcoin?

It’s up to them to invest where they want. Investors will have to ask what they’re investing in when they buy Tesla shares. The same is true for when investors buy into a car company, a crypto investment fund, etc.

What do you think about the argument that the dollar is used for financing terrorism?

I don’t think you can do very much about this, to be honest. It’s not like terrorism didn’t exist before the dollar.

Is the government inflating people’s wealth away?

In the U.S., inflation since the 1980s has averaged close to 2% per annum. If you are someone who held all your wealth in the form of cash, you would have seen a significant decline in your wealth over the years. But most people do not hold most of their wealth in the form of cash. And non-cash assets and securities tend to have rates of return that adjust with inflation.

What we have to be on guard for is sudden changes in the inflation rate, up or down. This is one of the main jobs of the central bank: to keep inflation low and stable. This is precisely why I say that while Bitcoin may make for a good long-run store of value, it makes for lousy money where the stability of the short-run rate of return is more important.

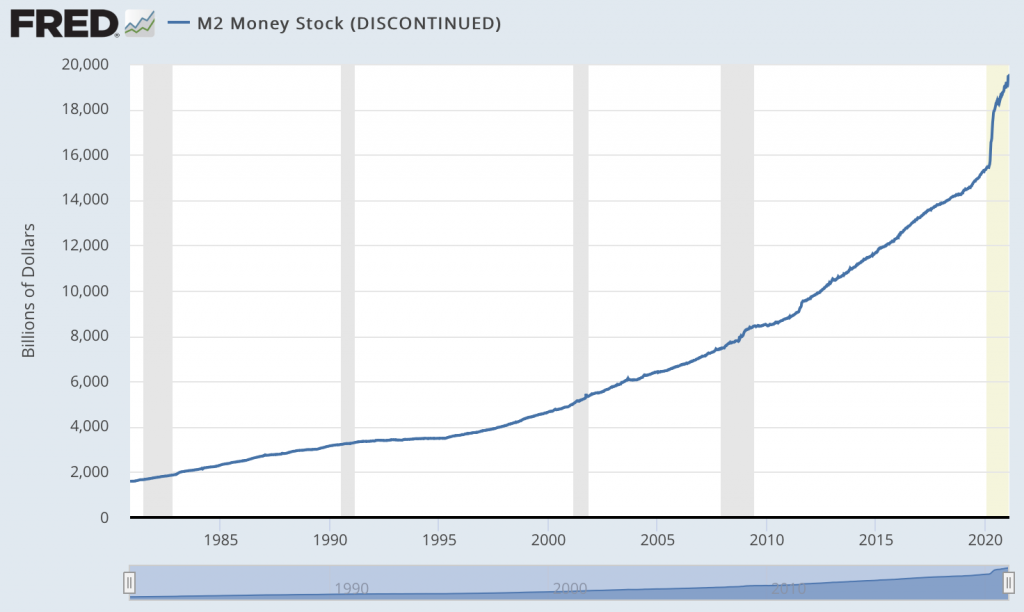

What is the M2 graph display?

M2 is a measure of a money supply. There is no unique definition of money, so economists have come up with a number of different definitions.

The next major part of the money supply is your checking accounts. So, when banks create loans, they also create deposit accounts that are redeemable on demand. So, if you count the checking accounts plus currency, it’s called M1. M2 is a bit broader than M1 because it also adds saving accounts. Looking at the M2 graph, you are seeing the money supply that is available to Americans and also people who have American checking accounts. That’s the money supply measure that’s plotted in the graph.

Does the M2 graph show the amount of printed money?

The M2 graph does not show you the money printed. Printing usually refers to paper bills. The bills in existence are not controlled by the government or by banks. The paper bills get into circulation where you go to a bank and withdraw them from your account. So, what you see here is not printing but banks issuing deposit liabilities to their customers rather than viewing this as money supply.

How does the M2 money supply increase?

In 1980, the federal government changed its monetary policy regime to an interest rate policy regime. Thus, the M2 graph mainly reflects the demand for money – not the money supply. What you see at the end of the graph is a sharp spike up in the demand for money. That spike displays all the firms that conducted withdrawals on their credit lines from their banks when the coronavirus broke in early 2020. If a company requests a credit to their deposit account with a million dollars, the company all of a sudden will have a million dollars in their savings account. And, our data picks it up due to the demand for money. The banks created the money that people and firms demanded. The other thing that’s contributing to the spike is that the government is printing a lot of debt to overcome this pandemic. These two factors account for most of that increase.

Recall that the Fed also lowered the interest rates pretty close to 0. Now, the interest rates for competing for safe securities are considerably lower than what it was prior to the crisis, thus the opportunity cost of holding money in a checking account isn’t so great.

Is inflation currently happening?

We haven’t seen inflation, at least not yet. Some people complain that the government statistics are bogus. But the privately-operated Billion Prices Project shows inflation that is consistent with government measures. Whether inflation becomes a problem in the future, we’ll have to wait and see. Certainly, the forecast is for a transitory increase in the rate of inflation as the economy re-opens from the pandemic.

Could Bitcoin be good for diversifying one’s portfolio?

Bitcoin could potentially be a good store of value for people who want to diversify their investment portfolio a little. I don’t think Bitcoin is going away any time soon. Historically, there have always been competing local currencies that would serve the local constituency, but in today’s modern age, a social network or locality is no longer constrained by physical proximity. Bitcoin serves a constituency for people who value the permissionless aspect and don’t trust the government. Bitcoin isn’t the only cryptocurrency out there, and there are many more variances designed in a way that serves their niche markets – their niche constituency.

Would Bitcoin make a good currency system?

I do not think so–please see my blog post on why gold and bitcoin are lousy money systems.

Interviewer , Editor : Lina Kamada

【Disclaimer】

The Article published on this our Homepage are only for the purpose of providing information. This is not intended as a solicitation for cryptocurrency trading. Also, this article is the author’s personal opinions, and this does not represent opinion for the Company BTCBOX co.,Ltd.