IntoTheBlock, ITB, is a tribe of data scientists, cryptocurrency experts, and AI geeks that are trying to unlock the mysteries of crypto assets. They provide investors with relevant intelligence about the market with their unique indicators and metrics. IntoTheBlock has been created to leverage the power of machine learning to generate new insights about this fascinating asset class. For this, we had Nicolas Contasti, Head of Sales & Business Development, and Francesco Galati from the Business Development team at ITB to tell us more about their services and products.

Interview Date : 16th February 2021

What categories do you have?

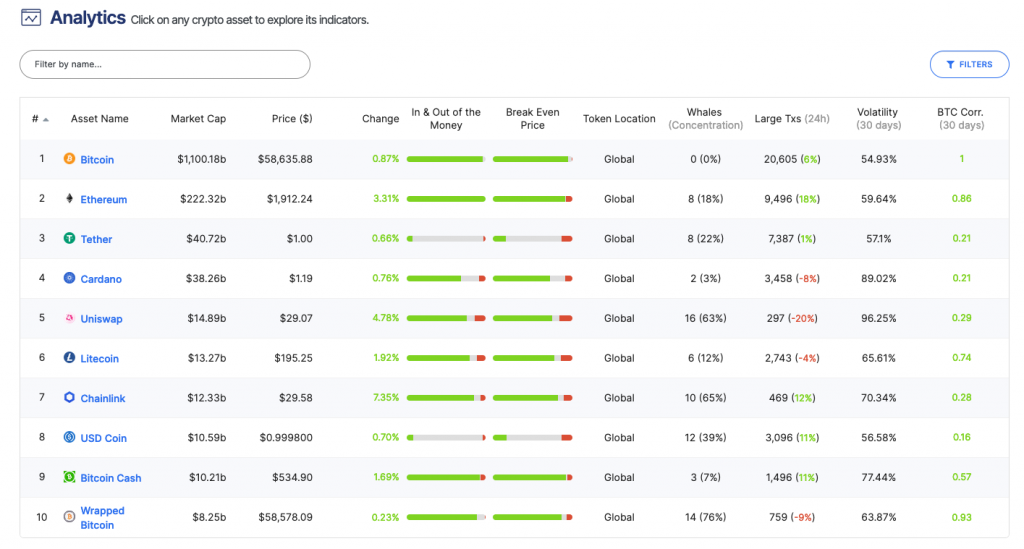

Our platform is divided into 4 different sections: Analytics, Predictions, DeFi Insights, and our latest addition called Capital Markets Insights.

Our Analytics product is subdivided into two major sections: The Quick View dashboard, which shows a few key data points; and the Deep Dive section with 70+ indicators comprised in 6 different categories: Financial indicators, Network indicators, Ownership indicators, Exchanges, Social indicators, and Derivative analytics.

How is the Quick View dashboard set up?

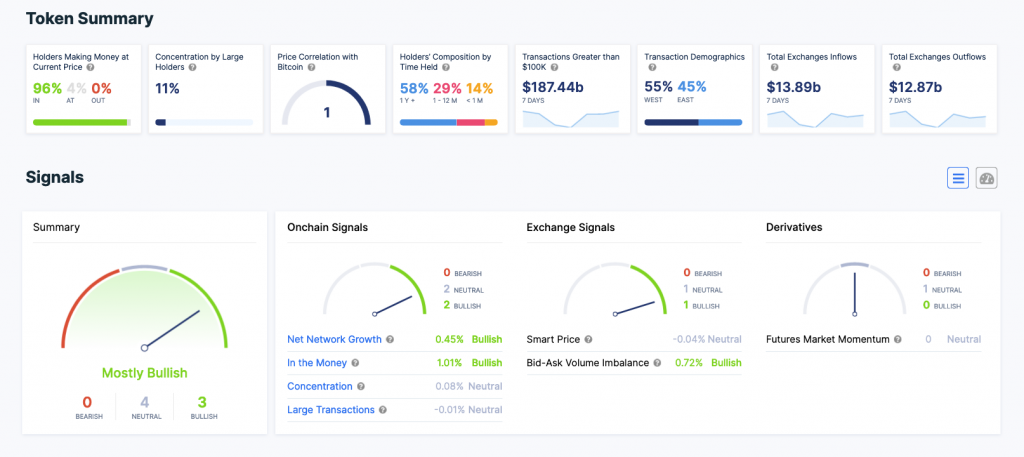

We have divided this dashboard into 3 main parts. The section on the top is called the Token Summary and it includes summarized views of some of the most interesting indicators from ITB Pro while allowing you to get a general overview of the current state of an asset like Bitcoin. For instance, within the Token Summary, you can take a look at the “Holder’s Making Money at Current Price”, which accurately displays the percentage of Bitcoin addresses that are currently profitable.

One of my favorite indicators is the “Holder’s Composition by Time Held”, which helps us to understand if users are more likely to trade it in a short-term timeframe or if they are holding a certain asset as a long-term investment. As you can see at this moment, about 61% of the holders haven’t moved their Bitcoin in the last year.

The rest of the sections comprise our momentum-based Signals, which are then divided into four (4) Onchain signals, two (2) Exchange Signals, and a single Derivatives signal.

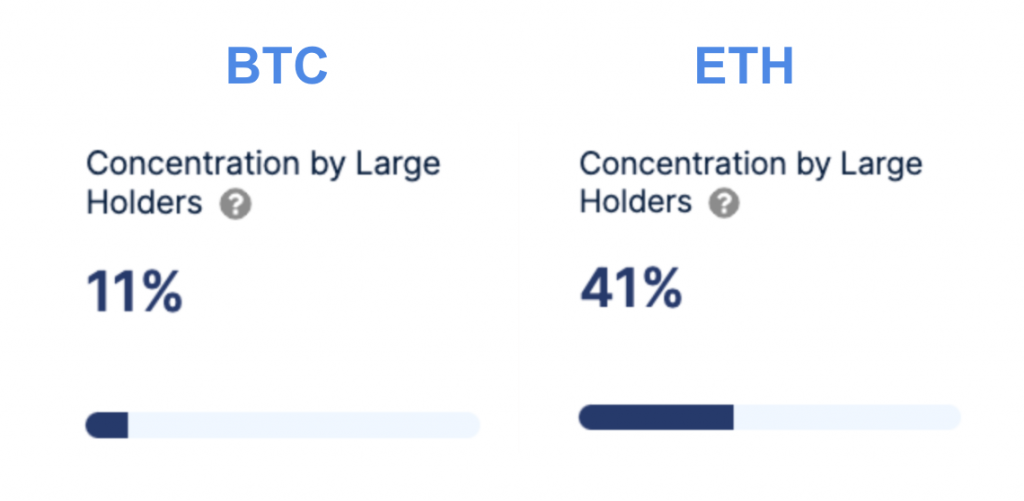

What does “Concentration by Large Holders” mean?

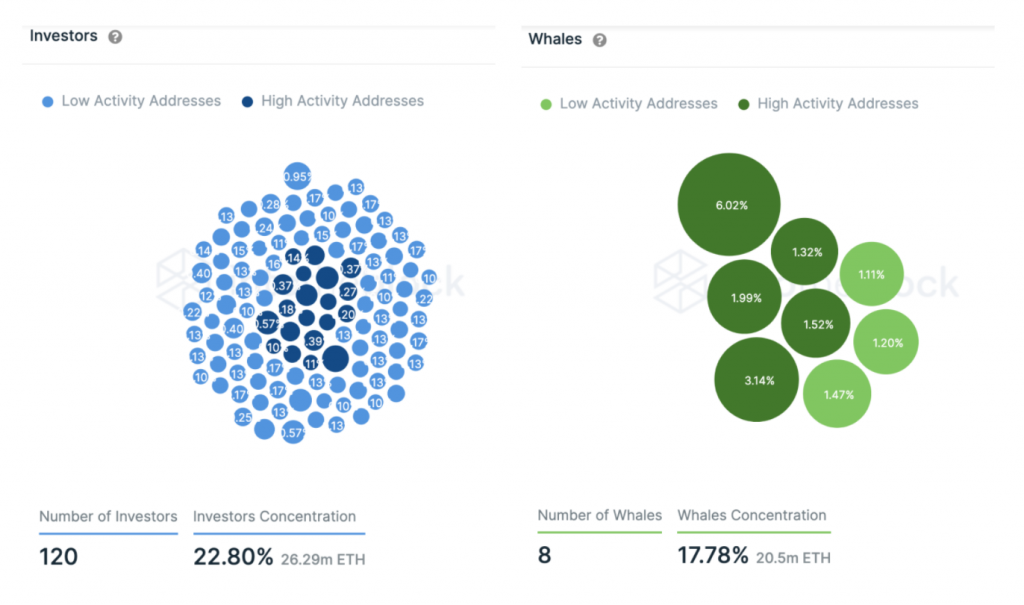

Concentration by Large Holders is an indicator designed to account for the percentage of tokens in circulation from a given asset that is being held by “whales” or “large addresses”. Hence, it gives an idea of how much exposure or risk you are undertaking by investing in a crypto-asset with high concentration.

Right now, we can see that about 11% of the total supply of Bitcoin is concentrated within a relatively small group or large players, which suggests a fairly low exposure in this topic when compared to another crypto asset. In Ethereum, for example, this number is about 41%.

How often are the Exchange signals updated?

Activity in spot exchanges is usually very high, therefore, our Exchange signals are updated once every minute and users can see how our gauges change according to the activity in the order book of several exchanges.

Conversely, the signals composed in our Onchain section get updated a few times a day since the activity at the on-chain level is significantly slower than in exchanges, and we also have to process all the data coming from multiple blockchains. In addition, we are hosting several Terabytes of data and some analyses have to compile hours of data in order for these signals to work through momentum.

Does IntoTheBlock use several data streams?

Yes, we use a mixture of on-chain data and off-chain data, as well as pricing information, community/developer driven-data, and Social Media data from multiple platforms. Certainly, the on-chain aspect of ITB is one of our strongest points because it is the part that we initially developed as the basis of the platform, but since our launch back in December 2019, we have been adding layers of information to provide a holistic view of a crypto-assets behavior through dozens of indicators and signals.

Does off-chain data take more time to get?

No, off-chain is actually not that difficult to get as there is a vast amount of data vendors. One issue, for example, comes from the high number of exchanges to which ITB must pull data, but if you have the right partners in place (such as Coingecko, and CryptoCompare) this issue can be easily solved.

Our connection with our partners is quite good, and that is why we are able to refresh our Exchange signals so often. So, once a minute our API pulls data from dozens of exchanges and all ITB Pro users are able to see order-book data almost immediately. We have onboarded close to 1000 different crypto assets across multiple blockchains, which gives us coverage of about 80% of the market.

How did IntoTheBlock start?

IntoTheBlock (ITB) is the result of a macro thesis formulated by our founder and CEO Jesus Rodriguez. Jesus has a long career in technology and finance. Having been a distinguished engineer at Microsoft and later built quant systems for major hedge funds on Wall Street, he has a deep understanding of the intersection of financial markets and tech. His main thesis was (and still is) that crypto products should be intelligent-first products, that is, powered by artificial intelligence. If traditional financial markets are evolving towards AI-first products, why shouldn’t crypto, the first natively digital asset class, do the same? The problem in crypto is that the foundational layer for building intelligent products – the data layer – was not there. So Jesus and the IntoTheBlock team set out to build a data company that would first serve the market as a whole but which could later leverage its infrastructure to build intelligent-first products.

This company is today IntoTheBlock, and it essentially started by gathering every single data point about crypto-assets from blockchains, exchange, social, derivative data and running many statistical and machine learning models on top of that to come up with unique insights about the crypto asset. These insights are delivered via charts and a slick UI in the ITB platform in a way that both institutional and retail investors can easily understand.

Who is your platform for?

Every platform will have its own vision of how to create actionable intelligence that is easily understandable from the vast amounts of data available in blockchains. Our initial approach was to create a platform that, although we don’t provide financial advice, would help retail investors and sophisticated traders to make better investment decisions. Therefore, we set out to create multiple tools to help bridge the gap between sophisticated traders and new retail investors wanting to understand and get into crypto with human relatable indicators.

Do you support blockchain nodes?

Yes, we run nodes of all the blockchains that we support, and that allows us to get access to complete transactional activities in these networks and run our analyses back in time. It also allows us to process and store large amounts of data, to the point that we are currently hosting around 20 – 25 terabytes of raw blockchain data, growing at a pace of about 50 gigabytes per day.

Interviewer , Editor : Lina Kamada

【Disclaimer】

The Article published on this our Homepage are only for the purpose of providing information. This is not intended as a solicitation for cryptocurrency trading. Also, this article is the author’s personal opinions, and this does not represent opinion for the Company BTCBOX co.,Ltd.